A Leading Provider of Real Estate Capital To State-Licensed Cannabis Operators August 7, 2025

newlake.comOTCQX: NLCP 2 This presentation has been prepared by NewLake Capital Partners, Inc. (“we”,” “us” or the “Company”) solely for informational purposes. This presentation and related discussion shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of securities. This presentation contains forward‐looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts, and are often indicated by words such as “anticipates,” “estimates,” “expects,” “intends,” “plans,” “believes,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” “and “could.” Forward looking statements include, among others, statements relating to the Company’s future financial performance, business prospects and strategy, the use of proceeds from our initial public offering, future dividend payments, anticipated financial position, the Company’s acquisition pipeline, liquidity and capital needs and other similar matters. These statements are based on the Company’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. The Company’s actual results may differ materially from those expressed in, or implied by, the forward-looking statements. The Company is providing the information contained herein as of the date of this presentation. Except as required by applicable law, the Company does not plan to update or revise any statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. Safe Harbor Statement Use of Non-GAAP Financial Information Adjusted Funds From Operations (“AFFO”) and Funds From Operations (“FFO”) are supplemental non-GAAP financial measures used in the real estate industry to measure and compare the operating performance of real estate companies. A complete reconciliation containing adjustments from GAAP net income attributable to common stockholders and participating securities to AFFO and FFO are included in the appendix to this presentation.

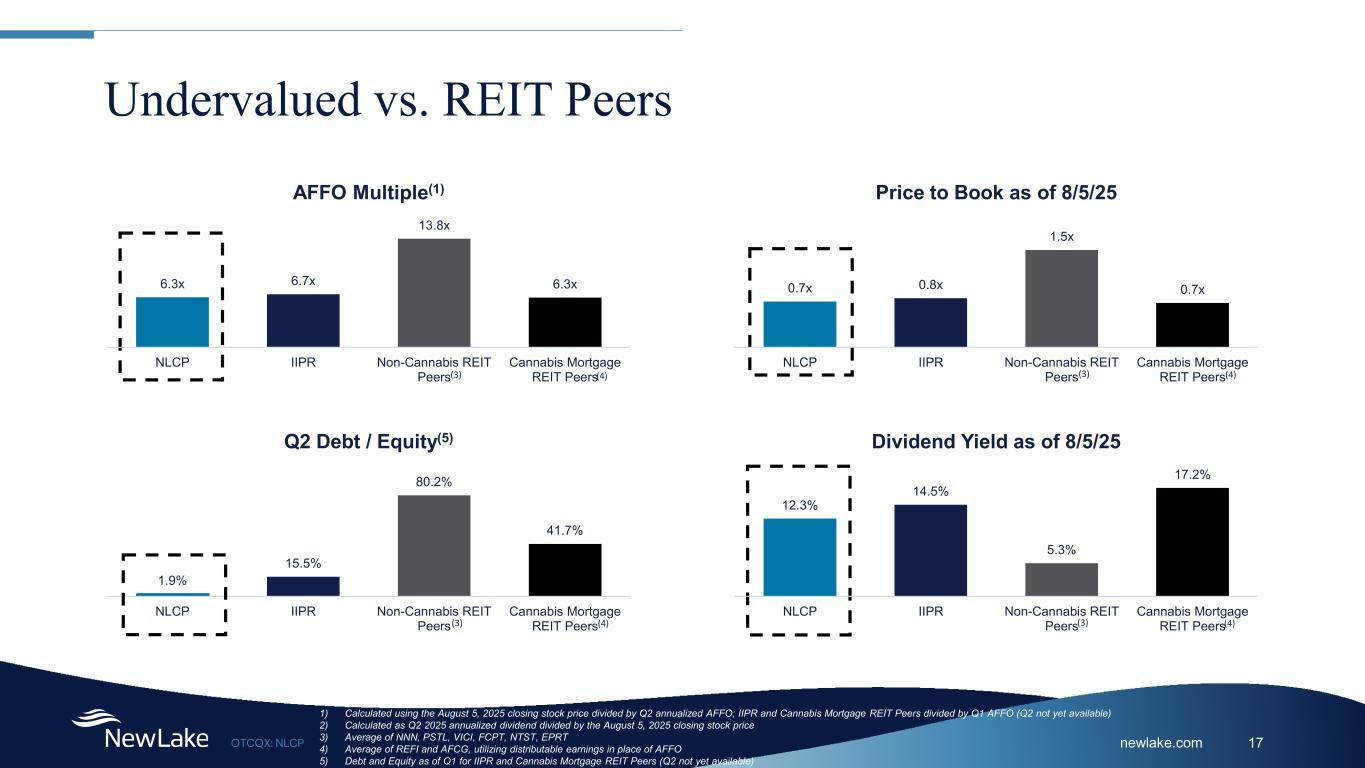

newlake.comOTCQX: NLCP 3 Investment Highlights Experienced Team Experienced team with a strong track record investing in cannabis real estate and delivering returns for investors Growth-Oriented Focus Cannabis is positioned for sustained long-term growth and requires significant real estate capital for expansion. Scale and Early Mover Second largest owner of cannabis real estate in the U.S.(1), building relationships and knowledge since 2019 Exceptional Portfolio Quality portfolio has delivered consistent dividend growth, up 79% since IPO, with 12.7 year weighted average remaining lease term Financial Position Solid financial position provides significant flexibility: $432 million in gross real estate assets, $8 million of debt outstanding on our $90 million credit facility and a 79% AFFO payout ratio Undervalued Compared to Peers At current valuation, NewLake is undervalued compared to REIT peers (1) Based on management estimates of third-party ownership.

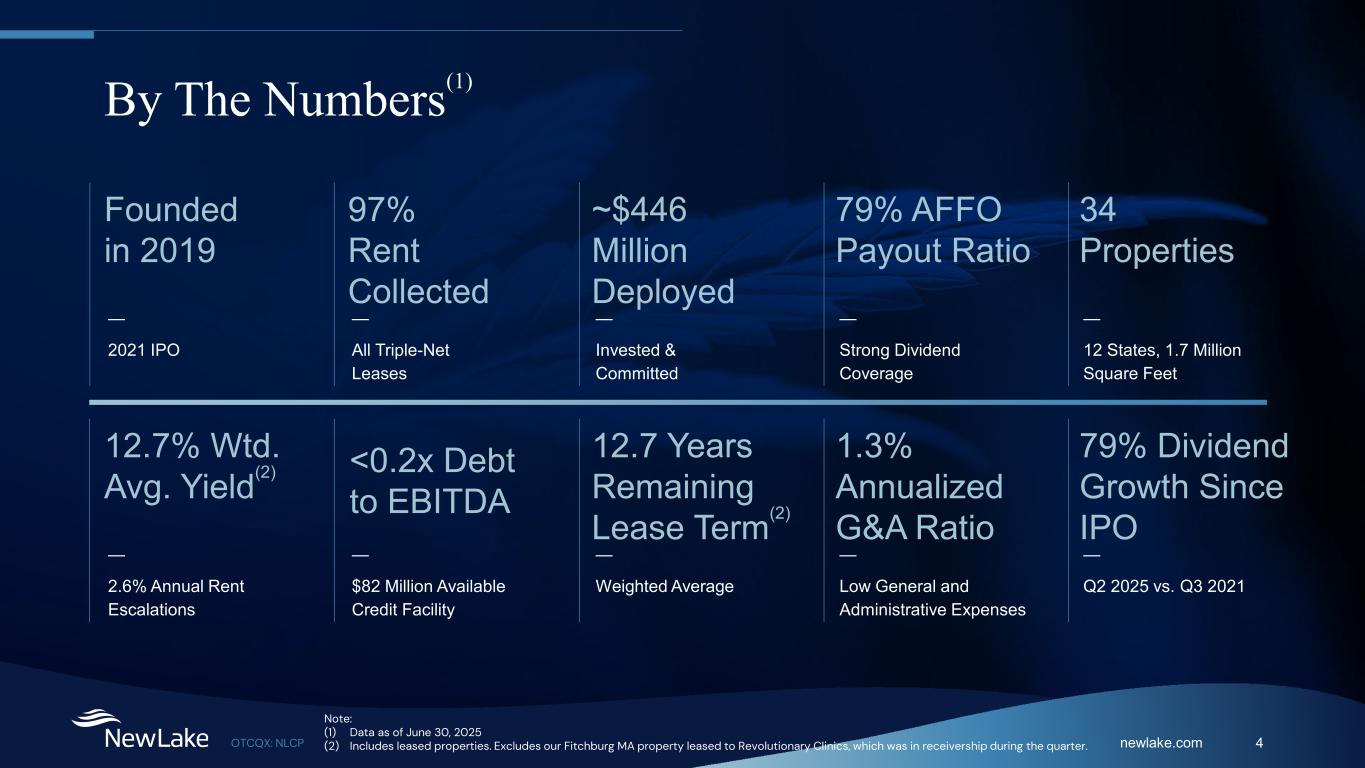

newlake.comOTCQX: NLCP 4 By The Numbers(1) 97% Rent Collected — All Triple-Net Leases Founded in 2019 — 2021 IPO ~$446 Million Deployed — Invested & Committed 79% AFFO Payout Ratio — Strong Dividend Coverage 34 Properties — 12 States, 1.7 Million Square Feet <0.2x Debt to EBITDA — $82 Million Available Credit Facility 12.7% Wtd. Avg. Yield(2) — 2.6% Annual Rent Escalations Note: (1) Data as of June 30, 2025 (2) Includes leased properties. Excludes our Fitchburg MA property leased to Revolutionary Clinics, which was in receivership during the quarter. 1.3% Annualized G&A Ratio — Low General and Administrative Expenses 12.7 Years Remaining Lease Term(2) — Weighted Average 79% Dividend Growth Since IPO — Q2 2025 vs. Q3 2021

newlake.comOTCQX: NLCP 5 Experienced Management Team Anthony Coniglio Chief Executive Officer & President, Director Lisa Meyer Chief Financial Officer, Treasurer & Secretary Former CEO of Primary Capital Mortgage, a residential mortgage company 14 years at J.P. Morgan as an investment banker leading various businesses Public company director Former President & CFO of Western Asset Mortgage Capital Corporation, a NYSE- listed REIT Extensive experience providing financial leadership to various public and private entities in the real estate industry Niki Krear Vice President of Acquisitions Former financial services experience at William Blair and Maranon Capital Background in investment banking, private credit, and real estate investing

newlake.comOTCQX: NLCP 6 Experienced Board of Directors Gordon DuGan Chairman of the Board, Independent Director Alan Carr Independent Director Joyce Johnson Independent Director Co-Founder and Chairman of the Board of Blackbrook Capital Former Chairman of the Board of INDUS Realty Trust (Nasdaq: INDT) Former CEO of Gramercy Property Trust, a NYSE-listed triple-net lease REIT Former CEO of W.P. Carey & CO., a NYSE- listed triple-net lease REIT Co-Founder and CEO of Drivetrain LLC. Director at Unit Corporation Previously served as Director on several other boards in diverse industries including Cazoo Group Ltd. Former Managing Director at Strategic Value Partners investing in various sectors in North America and Europe Chairman of Pacific Gate Capital Management, LLC, an investment firm Former Senior Managing Director and Partner of Relativity Capital, LLC and Managing Director of Cerberus Capital Management, L.P. Director at Ayr Wellness Experienced board member for 22 companies

newlake.comOTCQX: NLCP 7 Experienced Board of Directors Continued Peter Martay Independent Director David Weinstein Director CEO of Pangea Properties, a private apartment REIT that owned more than 13,000 apartments and completed over $500 million in short term bridge loans on numerous property types across the U.S. Former banker at Bernstein Global Wealth Management, Glencoe Capital and Deutsche Bank CEO of NewLake from August 2020 – July 2022, Director Since 2019 Former CEO of MPG Office Trust, a NYSE- listed office REIT 10 years at Goldman Sachs as a real estate investment banker and investor 10 years at Belvedere Capital, a real estate investment firm Dina Rollman Independent Director CEO of StrainBrain, an AI-powered technology company revolutionizing cannabis shopping experiences through personalized product recommendations Co-Founder and former SVP of Government Affairs at Green Thumb Industries, Inc., one of the leading public cannabis companies

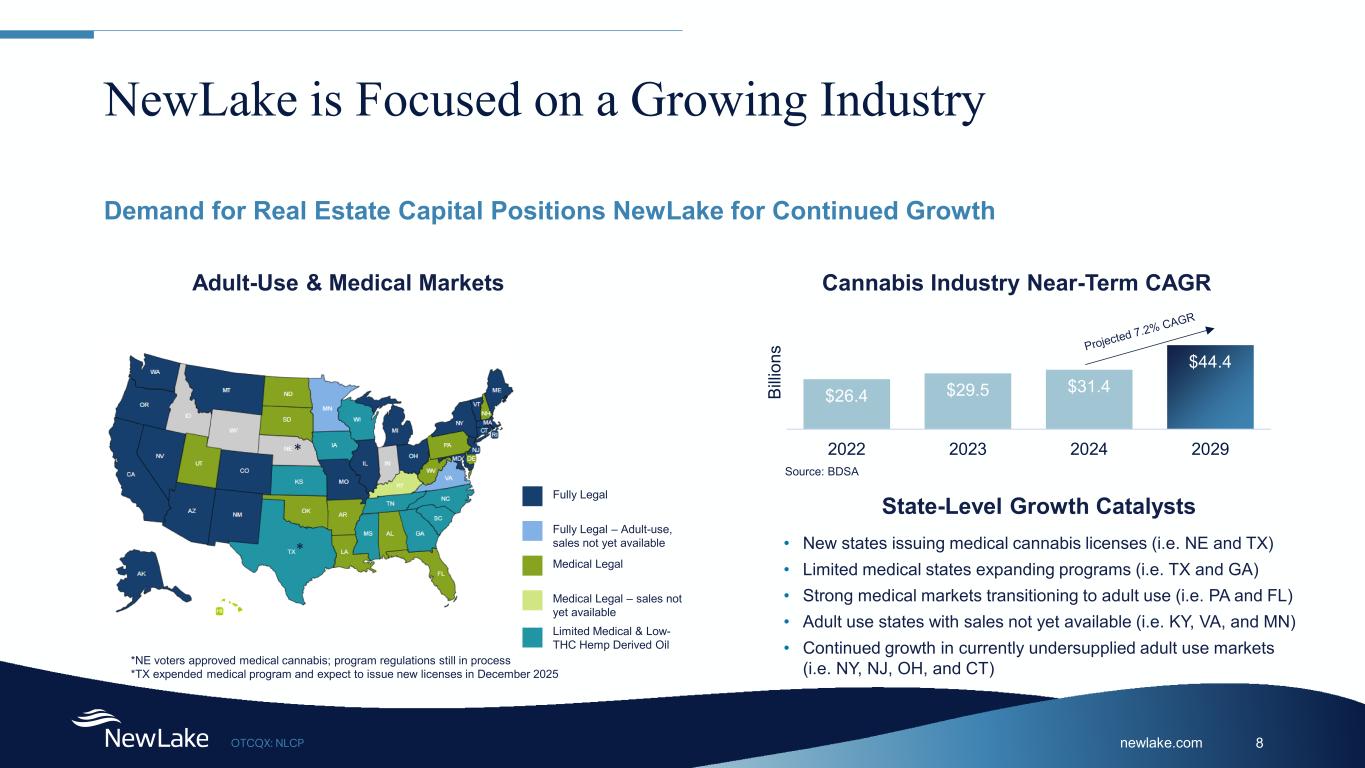

newlake.comOTCQX: NLCP 8 NewLake is Focused on a Growing Industry Demand for Real Estate Capital Positions NewLake for Continued Growth Adult-Use & Medical Markets Fully Legal – Adult-use, sales not yet available Fully Legal Medical Legal Limited Medical & Low- THC Hemp Derived Oil $26.4 $29.5 $31.4 $44.4 2022 2023 2024 2029 Bi llio ns Cannabis Industry Near-Term CAGR Source: BDSA • New states issuing medical cannabis licenses (i.e. NE and TX) • Limited medical states expanding programs (i.e. TX and GA) • Strong medical markets transitioning to adult use (i.e. PA and FL) • Adult use states with sales not yet available (i.e. KY, VA, and MN) • Continued growth in currently undersupplied adult use markets (i.e. NY, NJ, OH, and CT) State-Level Growth Catalysts Medical Legal – sales not yet available *NE voters approved medical cannabis; program regulations still in process *TX expended medical program and expect to issue new licenses in December 2025 * *

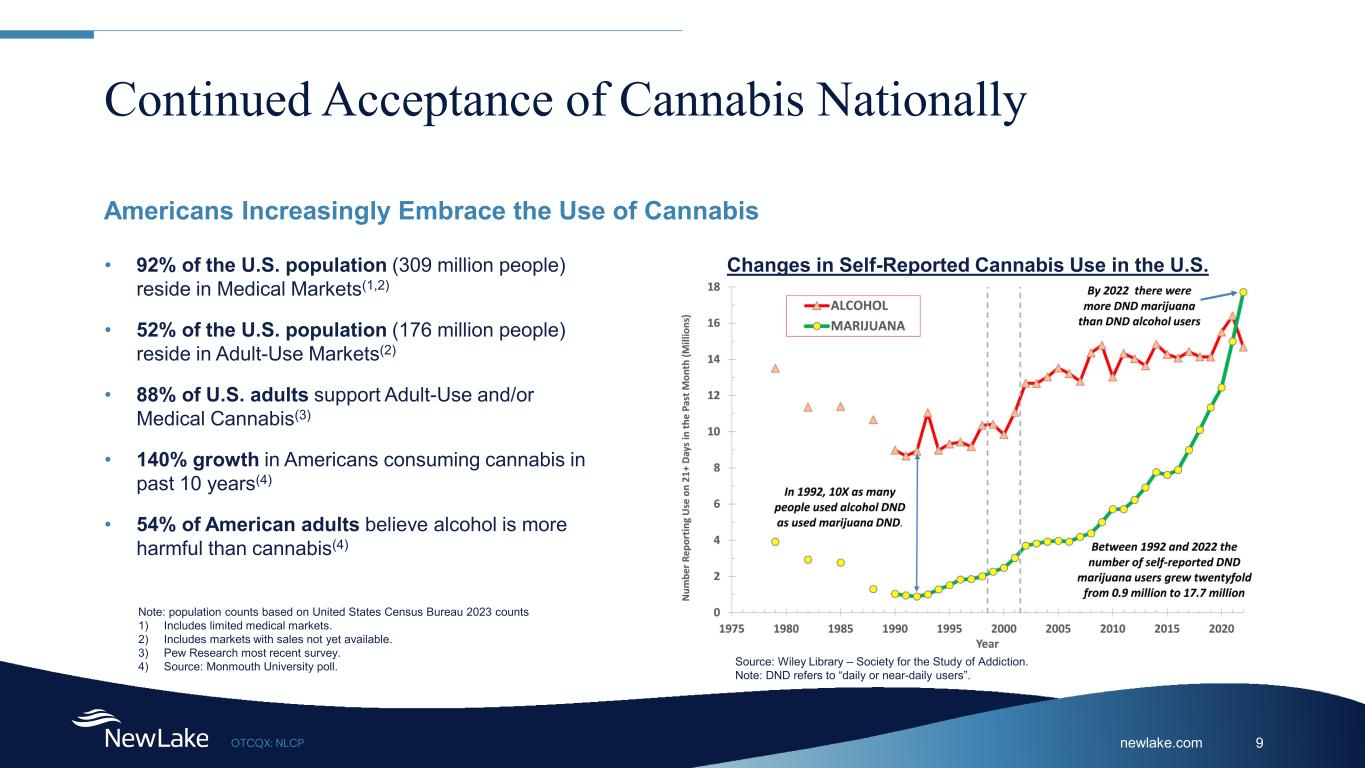

newlake.comOTCQX: NLCP 9 Continued Acceptance of Cannabis Nationally Americans Increasingly Embrace the Use of Cannabis • 92% of the U.S. population (309 million people) reside in Medical Markets(1,2) • 52% of the U.S. population (176 million people) reside in Adult-Use Markets(2) • 88% of U.S. adults support Adult-Use and/or Medical Cannabis(3) • 140% growth in Americans consuming cannabis in past 10 years(4) • 54% of American adults believe alcohol is more harmful than cannabis(4) Note: population counts based on United States Census Bureau 2023 counts 1) Includes limited medical markets. 2) Includes markets with sales not yet available. 3) Pew Research most recent survey. 4) Source: Monmouth University poll. Changes in Self-Reported Cannabis Use in the U.S. Source: Wiley Library – Society for the Study of Addiction. Note: DND refers to “daily or near-daily users”.

newlake.comOTCQX: NLCP 10 Industry Catalysts at Federal Level Legislative SAFER Banking Act, supported by President Trump, creates easier banking access for operators. STATES Act, supported by President Trump, decriminalizes cannabis and allows States to decide. Administrative DEA has proposed to reschedule cannabis from Schedule 1 to Schedule 3. President Trump stated support for Schedule 3, Adult Use and legislation focused on industry reform. Legal Federal Circuit Courts rule restrictions on gun rights for state-legal cannabis consumers unconstitutional. Lawsuit filed by operators led by David Boies argues states have right to regulate their own economies without federal oversight. Catalysts for reform are present across all three branches of Government

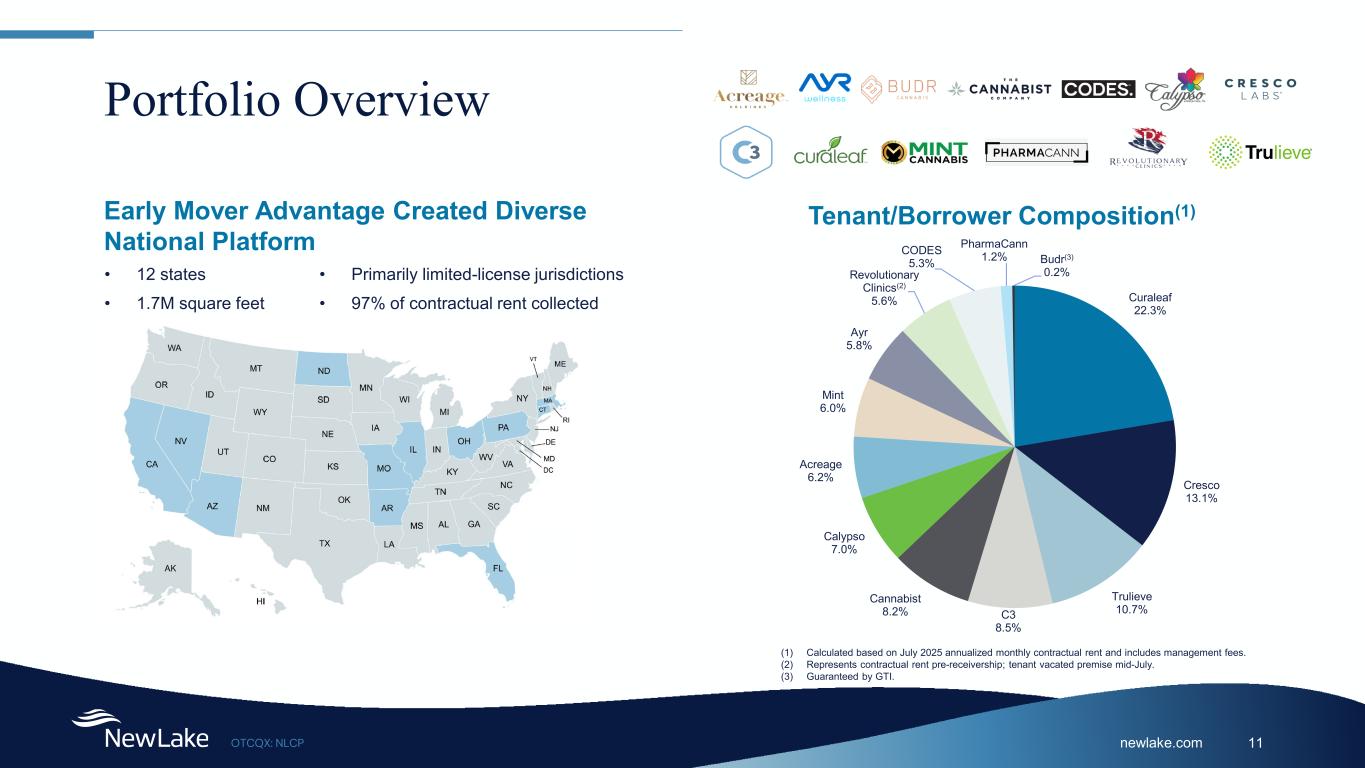

newlake.comOTCQX: NLCP 11 Portfolio Overview Early Mover Advantage Created Diverse National Platform • 12 states • 1.7M square feet • Primarily limited-license jurisdictions • 97% of contractual rent collected Curaleaf 22.3% Cresco 13.1% Trulieve 10.7%C3 8.5% Cannabist 8.2% Calypso 7.0% Acreage 6.2% Mint 6.0% Ayr 5.8% Revolutionary Clinics(2) 5.6% CODES 5.3% PharmaCann 1.2% Budr(3) 0.2% Tenant/Borrower Composition(1) (1) Calculated based on July 2025 annualized monthly contractual rent and includes management fees. (2) Represents contractual rent pre-receivership; tenant vacated premise mid-July. (3) Guaranteed by GTI.

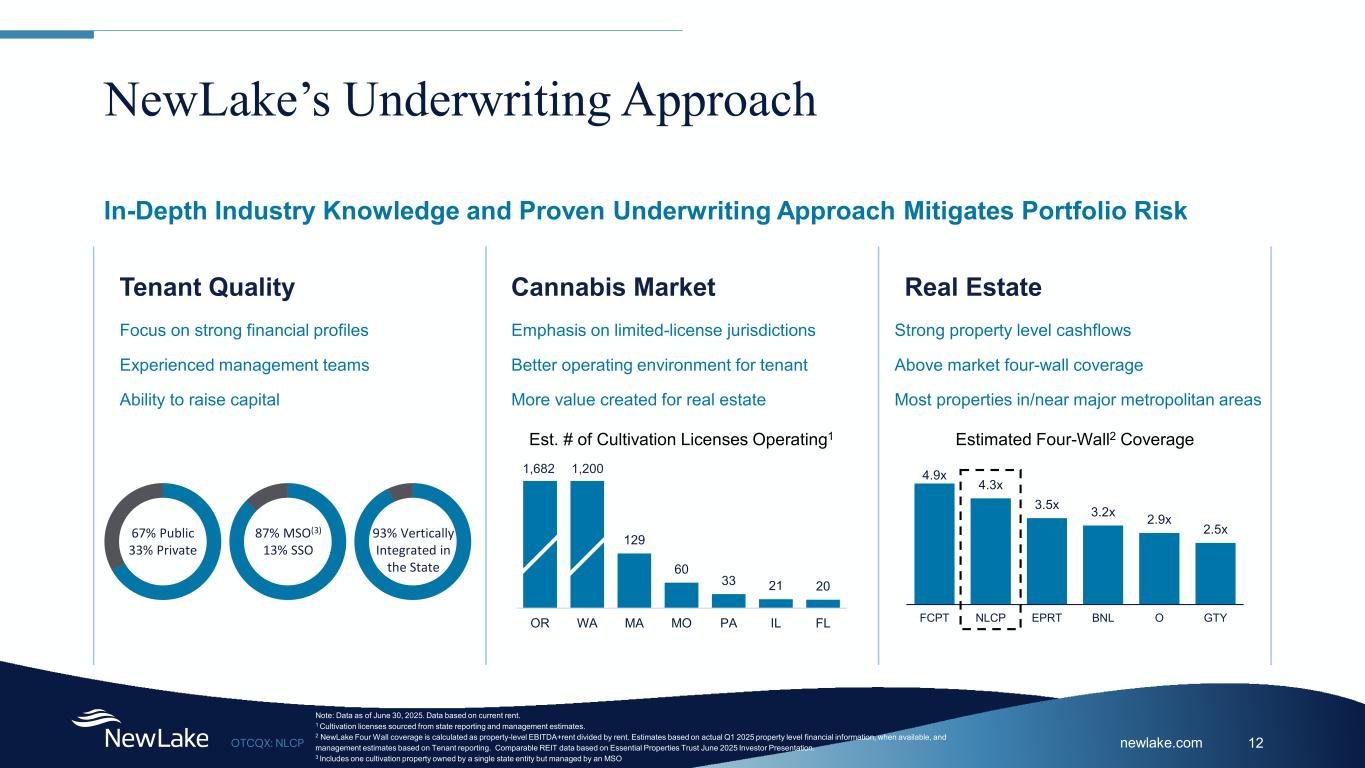

newlake.comOTCQX: NLCP 12 4.9x 4.3x 3.5x 3.2x 2.9x 2.5x FCPT NLCP EPRT BNL O GTY NewLake’s Underwriting Approach Tenant Quality Real Estate In-Depth Industry Knowledge and Proven Underwriting Approach Mitigates Portfolio Risk Focus on strong financial profiles Experienced management teams Ability to raise capital Strong property level cashflows Above market four-wall coverage Most properties in/near major metropolitan areas Estimated Four-Wall2 Coverage Note: Data as of June 30, 2025. Data based on current rent. 1 Cultivation licenses sourced from state reporting and management estimates. 2 NewLake Four Wall coverage is calculated as property-level EBITDA+rent divided by rent. Estimates based on actual Q1 2025 property level financial information, when available, and management estimates based on Tenant reporting. Comparable REIT data based on Essential Properties Trust June 2025 Investor Presentation. 3 Includes one cultivation property owned by a single state entity but managed by an MSO 67% Public 33% Private 87% MSO(3) 13% SSO 93% Vertically Integrated in the State Cannabis Market Emphasis on limited-license jurisdictions Better operating environment for tenant More value created for real estate 129 60 33 21 20 OR WA MA MO PA IL FL Est. # of Cultivation Licenses Operating1 1,682 1,200

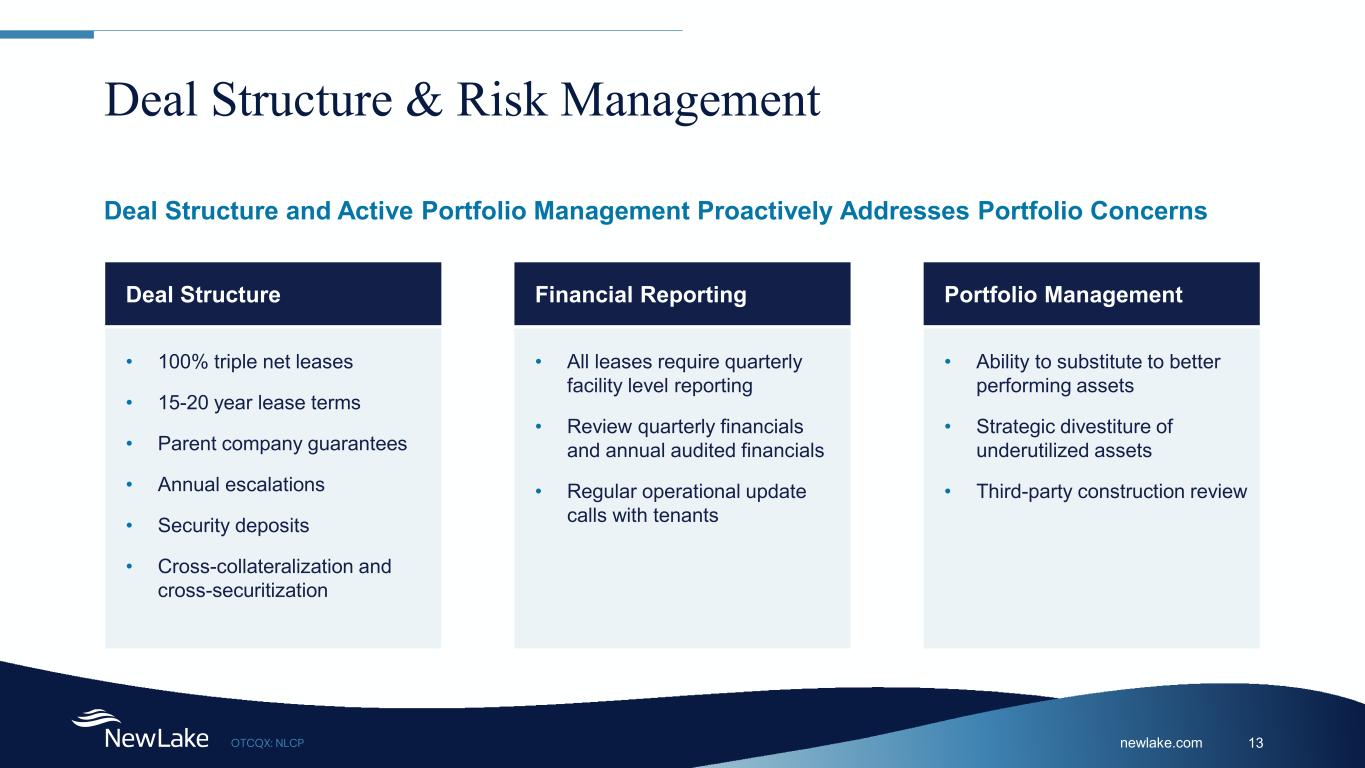

newlake.comOTCQX: NLCP 13 Deal Structure & Risk Management Deal Structure • 100% triple net leases • 15-20 year lease terms • Parent company guarantees • Annual escalations • Security deposits • Cross-collateralization and cross-securitization • Ability to substitute to better performing assets • Strategic divestiture of underutilized assets • Third-party construction review Financial Reporting Portfolio Management • All leases require quarterly facility level reporting • Review quarterly financials and annual audited financials • Regular operational update calls with tenants Deal Structure and Active Portfolio Management Proactively Addresses Portfolio Concerns

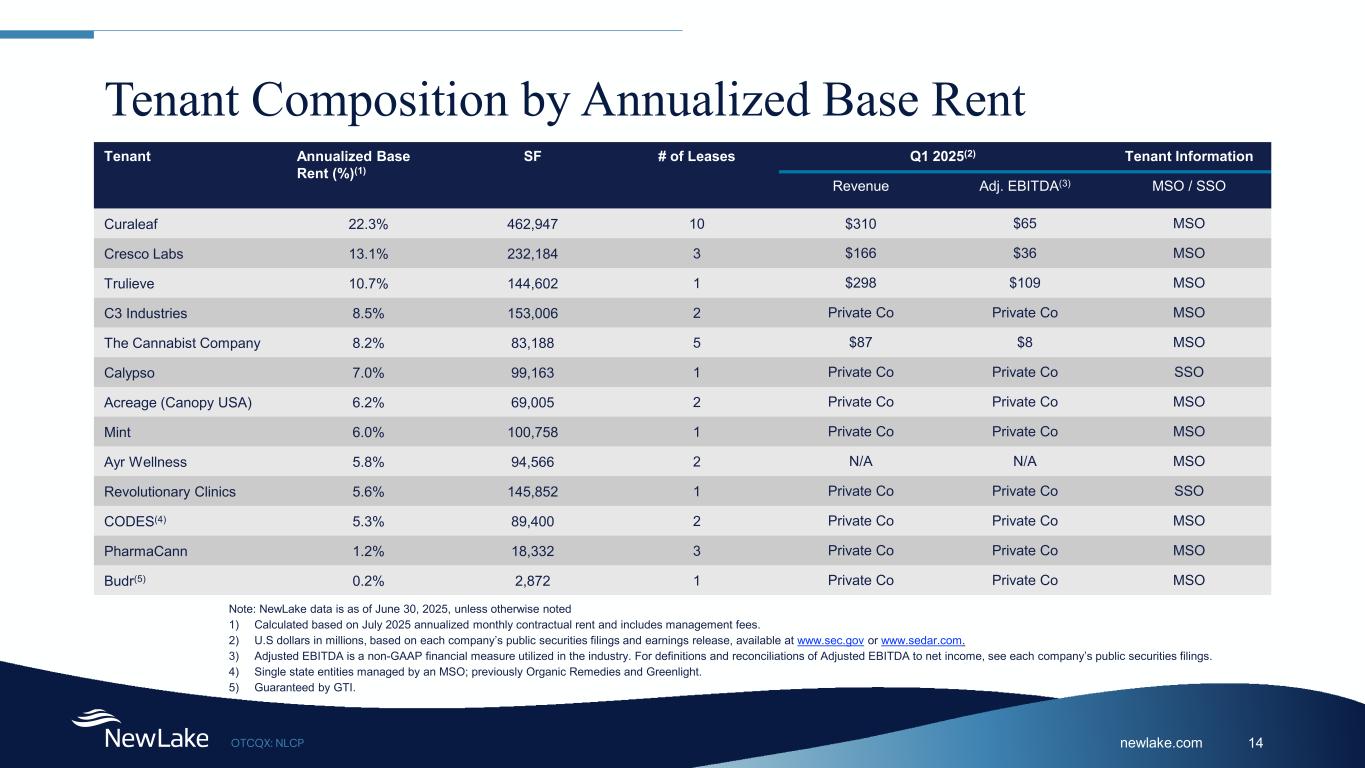

newlake.comOTCQX: NLCP 14 Tenant Composition by Annualized Base Rent Tenant Annualized Base Rent (%)(1) SF # of Leases Q1 2025(2) Tenant Information Revenue Adj. EBITDA(3) MSO / SSO Curaleaf 22.3% 462,947 10 $310 $65 MSO Cresco Labs 13.1% 232,184 3 $166 $36 MSO Trulieve 10.7% 144,602 1 $298 $109 MSO C3 Industries 8.5% 153,006 2 Private Co Private Co MSO The Cannabist Company 8.2% 83,188 5 $87 $8 MSO Calypso 7.0% 99,163 1 Private Co Private Co SSO Acreage (Canopy USA) 6.2% 69,005 2 Private Co Private Co MSO Mint 6.0% 100,758 1 Private Co Private Co MSO Ayr Wellness 5.8% 94,566 2 N/A N/A MSO Revolutionary Clinics 5.6% 145,852 1 Private Co Private Co SSO CODES(4) 5.3% 89,400 2 Private Co Private Co MSO PharmaCann 1.2% 18,332 3 Private Co Private Co MSO Budr(5) 0.2% 2,872 1 Private Co Private Co MSO Note: NewLake data is as of June 30, 2025, unless otherwise noted 1) Calculated based on July 2025 annualized monthly contractual rent and includes management fees. 2) U.S dollars in millions, based on each company’s public securities filings and earnings release, available at www.sec.gov or www.sedar.com. 3) Adjusted EBITDA is a non-GAAP financial measure utilized in the industry. For definitions and reconciliations of Adjusted EBITDA to net income, see each company’s public securities filings. 4) Single state entities managed by an MSO; previously Organic Remedies and Greenlight. 5) Guaranteed by GTI.

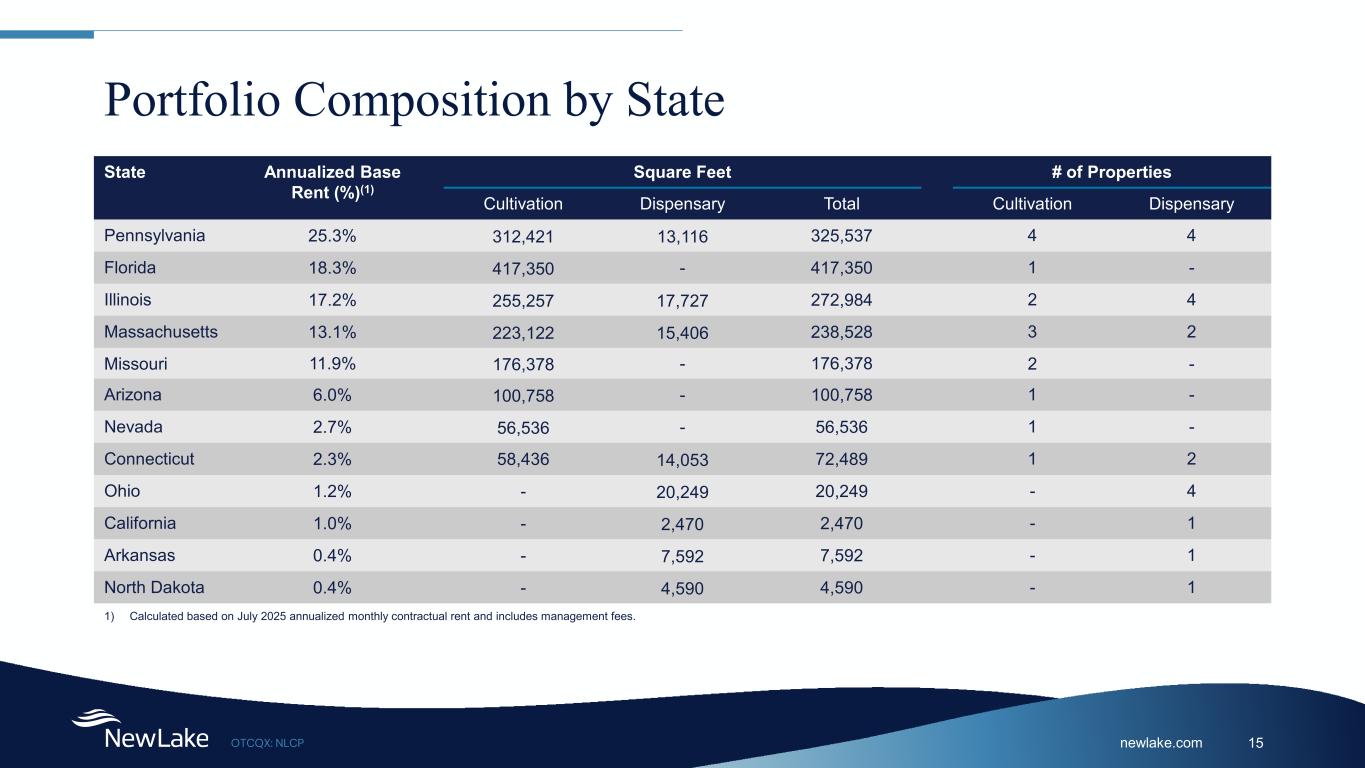

newlake.comOTCQX: NLCP 15 Portfolio Composition by State State Annualized Base Rent (%)(1) Square Feet # of Properties Cultivation Dispensary Total Cultivation Dispensary Pennsylvania 25.3% 312,421 13,116 325,537 4 4 Florida 18.3% 417,350 - 417,350 1 - Illinois 17.2% 255,257 17,727 272,984 2 4 Massachusetts 13.1% 223,122 15,406 238,528 3 2 Missouri 11.9% 176,378 - 176,378 2 - Arizona 6.0% 100,758 - 100,758 1 - Nevada 2.7% 56,536 - 56,536 1 - Connecticut 2.3% 58,436 14,053 72,489 1 2 Ohio 1.2% - 20,249 20,249 - 4 California 1.0% - 2,470 2,470 - 1 Arkansas 0.4% - 7,592 7,592 - 1 North Dakota 0.4% - 4,590 4,590 - 1 1) Calculated based on July 2025 annualized monthly contractual rent and includes management fees.

newlake.comOTCQX: NLCP 16 Financial Overview Stockholders’ Equity $393 Million Invested & Committed Capital $446 Million Cash $22 Million Debt $8 Million Market Capitalization1 $287 Million Stock Price1 $13.96 Dividend Yield2 12.3% Common Shares Outstanding 20,552,632 Book Value per share $19.11 2Q25 Annualized Dividend3 $1.72 Target AFFO Payout Ratio 80% - 90% 2Q25 Revenue Annualized4 $51.7 Million G&A Expense Ratio Annualized5 1.3% Key Data Dividend Growth per Share Note: Data is as of June 30, 2025, unless otherwise noted 1 Based on the Aug 5, 2025, closing price. 2 Calculated as Q2 2025 annualized dividend divided by the Aug 5, 2025, closing stock price. 3 Annualized based on Q2 2025 dividend of $0.43 per common share, declared on June 16, 2025. 4 Annualized revenue is calculated using actual revenue for the three months ended June 30, 2025. 5 Calculated using annualized General and Administrative Expense, excluding stock-based compensation, for the three months ending June 30, 2025, over Total Assets as of June 30, 2025. $0.43 $0.43 $0.43 $0.43 $0.43 $0.41 $0.40 $0.39 $0.39 $0.39 $0.39 $0.37 $0.35 $0.33 $0.31 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21

newlake.comOTCQX: NLCP 17 1.9% 15.5% 80.2% 41.7% NLCP IIPR Non-Cannabis REIT Peers Cannabis Mortgage REIT Peers Q2 Debt / Equity(5) Undervalued vs. REIT Peers 1) Calculated using the August 5, 2025 closing stock price divided by Q2 annualized AFFO; IIPR and Cannabis Mortgage REIT Peers divided by Q1 AFFO (Q2 not yet available) 2) Calculated as Q2 2025 annualized dividend divided by the August 5, 2025 closing stock price 3) Average of NNN, PSTL, VICI, FCPT, NTST, EPRT 4) Average of REFI and AFCG, utilizing distributable earnings in place of AFFO 5) Debt and Equity as of Q1 for IIPR and Cannabis Mortgage REIT Peers (Q2 not yet available) (3) (3) (3) (3) (4) (4) (4) (4) 6.3x 6.7x 13.8x 6.3x NLCP IIPR Non-Cannabis REIT Peers Cannabis Mortgage REIT Peers AFFO Multiple(1) 0.7x 0.8x 1.5x 0.7x NLCP IIPR Non-Cannabis REIT Peers Cannabis Mortgage REIT Peers Price to Book as of 8/5/25 12.3% 14.5% 5.3% 17.2% NLCP IIPR Non-Cannabis REIT Peers Cannabis Mortgage REIT Peers Dividend Yield as of 8/5/25

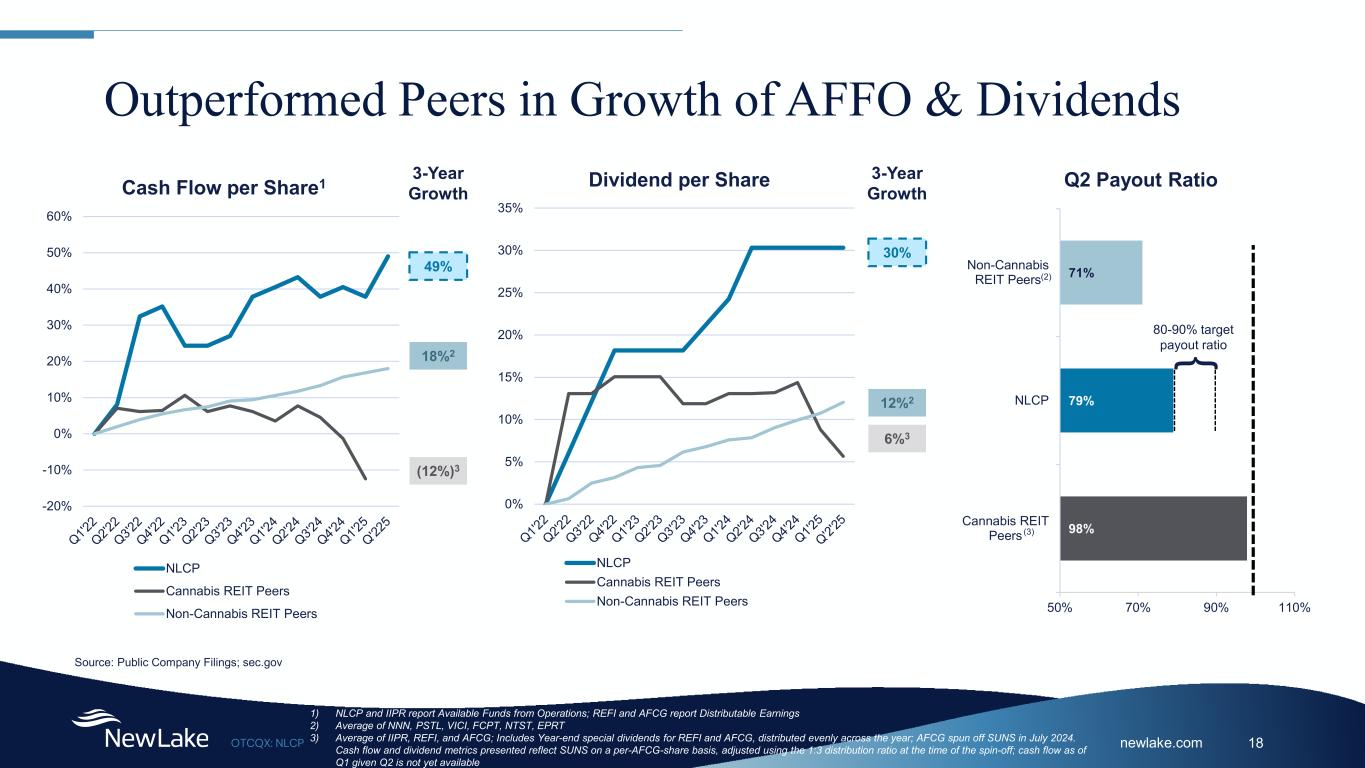

newlake.comOTCQX: NLCP 18 Outperformed Peers in Growth of AFFO & Dividends 3-Year Growth (12%)3 49% 3-Year Growth 6%3 30% 1) NLCP and IIPR report Available Funds from Operations; REFI and AFCG report Distributable Earnings 2) Average of NNN, PSTL, VICI, FCPT, NTST, EPRT 3) Average of IIPR, REFI, and AFCG; Includes Year-end special dividends for REFI and AFCG, distributed evenly across the year; AFCG spun off SUNS in July 2024. Cash flow and dividend metrics presented reflect SUNS on a per-AFCG-share basis, adjusted using the 1:3 distribution ratio at the time of the spin-off; cash flow as of Q1 given Q2 is not yet available Source: Public Company Filings; sec.gov -20% -10% 0% 10% 20% 30% 40% 50% 60% Cash Flow per Share1 NLCP Cannabis REIT Peers Non-Cannabis REIT Peers 0% 5% 10% 15% 20% 25% 30% 35% Dividend per Share NLCP Cannabis REIT Peers Non-Cannabis REIT Peers 18%2 12%2 98% 79% 71% 50% 70% 90% 110% Cannabis REIT Peers NLCP Non-Cannabis REIT Peers Q2 Payout Ratio } 80-90% target payout ratio (2) (3)

newlake.comOTCQX: NLCP 19 Investment Highlights Experienced Team Experienced team with a strong track record investing in cannabis real estate and delivering returns for investors Growth-Oriented Focus Cannabis is positioned for sustained long-term growth and requires significant real estate capital for expansion. Scale and Early Mover Second largest owner of cannabis real estate in the U.S.(1), building relationships and knowledge since 2019 Exceptional Portfolio Quality portfolio has delivered consistent dividend growth, up 79% since IPO, with 12.7 year weighted average remaining lease term Financial Position Solid financial position provides significant flexibility: $432 million in gross real estate assets, $8 million of debt outstanding on our $90 million credit facility and an 79% AFFO payout ratio Undervalued Compared to Peers At current valuation, NewLake is undervalued compared to REIT peers (1) Based on management estimates of third-party ownership.

newlake.comOTCQX: NLCP 20 How to Buy Our Stock E-Trade ----------------------------------------------- 800.387.2331 Charles Schwab ------------------------------------ 866.855.9102 Interactive Brokers --------------------------------- 877.442.2757 StoneX ------------------------------------------------ www.stonex.com Roth Capital ----------------------------------------- 800.678.9147 ATB ---------------------------------------------------- atbcm.atb.com BTIG --------------------------------------------------- www.btig.com Jones Trading --------------------------------------- 800.203.6611 Fidelity ------------------------------------------------ 800.972.2155 Ameriprise-------------------------------------------- 800.862.7919 Wells Fargo Advisors------------------------------ 877.573.7997 You can buy NewLake Capital share on the US OTC Markets under the ticker symbol NLCP with the brokers listed below. Note: Brokers are based on the Company's most recent knowledge. Broker policies may change without notice.

Supplemental Information

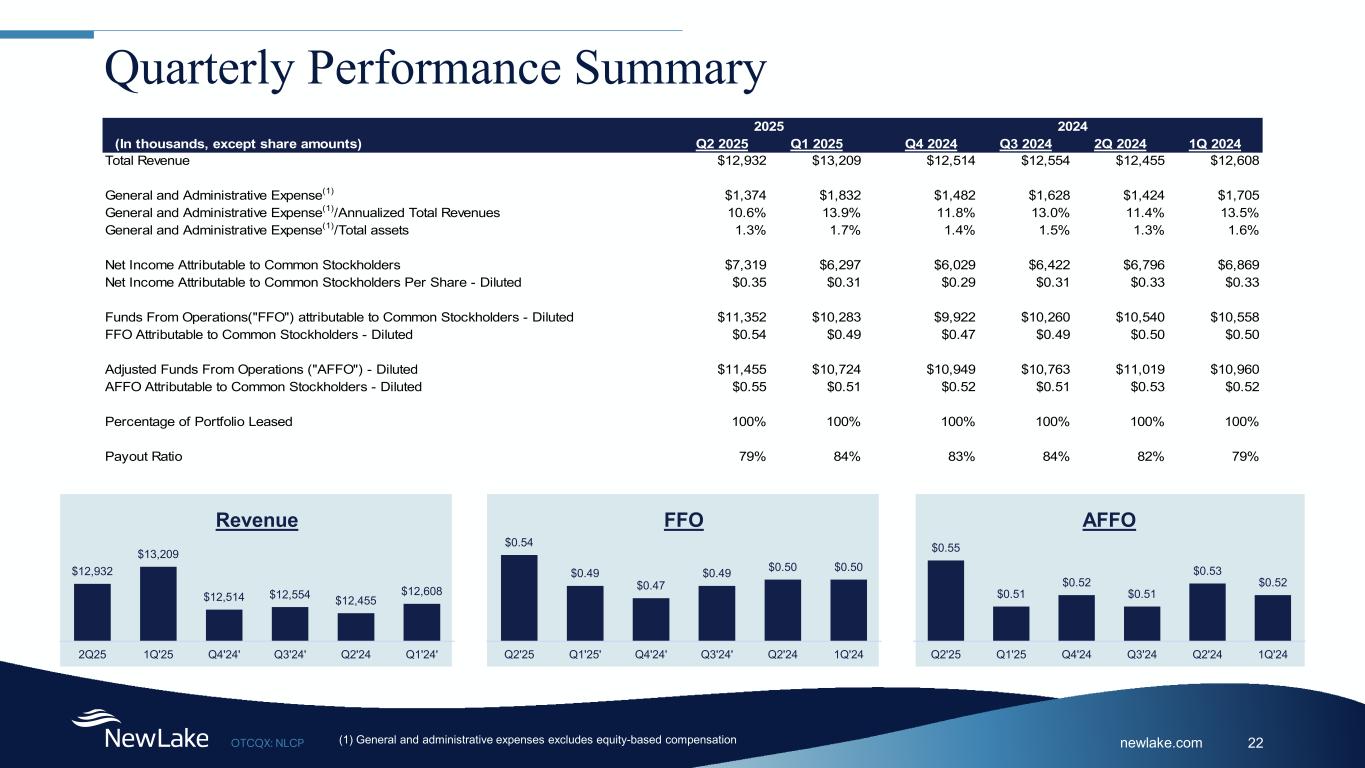

newlake.comOTCQX: NLCP 22 Quarterly Performance Summary (1) General and administrative expenses excludes equity-based compensation $12,932 $13,209 $12,514 $12,554 $12,455 $12,608 2Q25 1Q'25 Q4'24' Q3'24' Q2'24 Q1'24' Revenue $0.55 $0.51 $0.52 $0.51 $0.53 $0.52 Q2'25 Q1'25 Q4'24 Q3'24 Q2'24 1Q'24 AFFO $0.54 $0.49 $0.47 $0.49 $0.50 $0.50 Q2'25 Q1'25' Q4'24' Q3'24' Q2'24 1Q'24 FFO (In thousands, except share amounts) Q2 2025 Q1 2025 Q4 2024 Q3 2024 2Q 2024 1Q 2024 Total Revenue $12,932 $13,209 $12,514 $12,554 $12,455 $12,608 General and Administrative Expense(1) $1,374 $1,832 $1,482 $1,628 $1,424 $1,705 General and Administrative Expense(1)/Annualized Total Revenues 10.6% 13.9% 11.8% 13.0% 11.4% 13.5% General and Administrative Expense(1)/Total assets 1.3% 1.7% 1.4% 1.5% 1.3% 1.6% Net Income Attributable to Common Stockholders $7,319 $6,297 $6,029 $6,422 $6,796 $6,869 Net Income Attributable to Common Stockholders Per Share - Diluted $0.35 $0.31 $0.29 $0.31 $0.33 $0.33 Funds From Operations("FFO") attributable to Common Stockholders - Diluted $11,352 $10,283 $9,922 $10,260 $10,540 $10,558 FFO Attributable to Common Stockholders - Diluted $0.54 $0.49 $0.47 $0.49 $0.50 $0.50 Adjusted Funds From Operations ("AFFO") - Diluted $11,455 $10,724 $10,949 $10,763 $11,019 $10,960 AFFO Attributable to Common Stockholders - Diluted $0.55 $0.51 $0.52 $0.51 $0.53 $0.52 Percentage of Portfolio Leased 100% 100% 100% 100% 100% 100% Payout Ratio 79% 84% 83% 84% 82% 79% 2025 2024

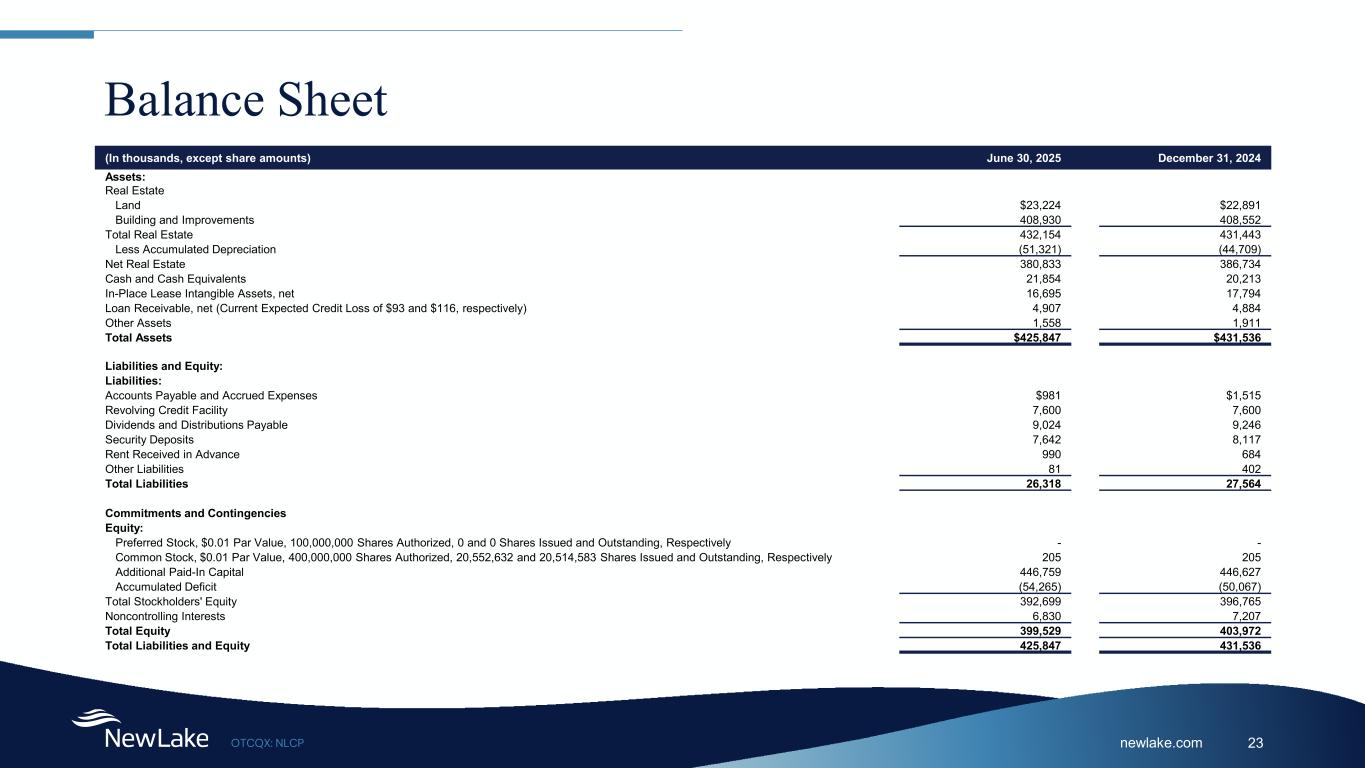

newlake.comOTCQX: NLCP 23 Balance Sheet (In thousands, except share amounts) June 30, 2025 December 31, 2024 Assets: Real Estate Land $23,224 $22,891 Building and Improvements 408,930 408,552 Total Real Estate 432,154 431,443 Less Accumulated Depreciation (51,321) (44,709) Net Real Estate 380,833 386,734 Cash and Cash Equivalents 21,854 20,213 In-Place Lease Intangible Assets, net 16,695 17,794 Loan Receivable, net (Current Expected Credit Loss of $93 and $116, respectively) 4,907 4,884 Other Assets 1,558 1,911 Total Assets $425,847 $431,536 Liabilities and Equity: Liabilities: Accounts Payable and Accrued Expenses $981 $1,515 Revolving Credit Facility 7,600 7,600 Dividends and Distributions Payable 9,024 9,246 Security Deposits 7,642 8,117 Rent Received in Advance 990 684 Other Liabilities 81 402 Total Liabilities 26,318 27,564 Commitments and Contingencies Equity: Preferred Stock, $0.01 Par Value, 100,000,000 Shares Authorized, 0 and 0 Shares Issued and Outstanding, Respectively - - Common Stock, $0.01 Par Value, 400,000,000 Shares Authorized, 20,552,632 and 20,514,583 Shares Issued and Outstanding, Respectively 205 205 Additional Paid-In Capital 446,759 446,627 Accumulated Deficit (54,265) (50,067) Total Stockholders' Equity 392,699 396,765 Noncontrolling Interests 6,830 7,207 Total Equity 399,529 403,972 Total Liabilities and Equity 425,847 431,536

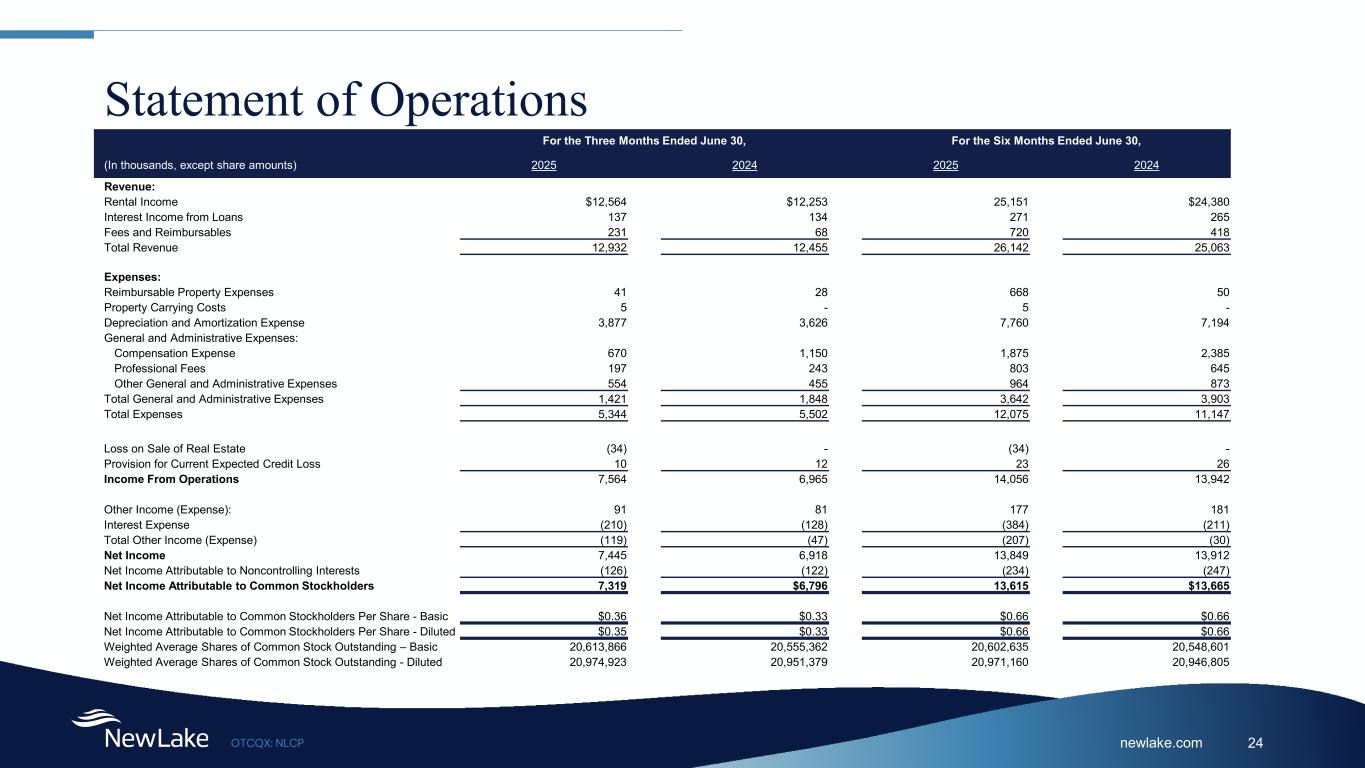

newlake.comOTCQX: NLCP 24 Statement of Operations For the Three Months Ended June 30, For the Six Months Ended June 30, (In thousands, except share amounts) 2025 2024 2025 2024 Revenue: Rental Income $12,564 $12,253 25,151 $24,380 Interest Income from Loans 137 134 271 265 Fees and Reimbursables 231 68 720 418 Total Revenue 12,932 12,455 26,142 25,063 Expenses: Reimbursable Property Expenses 41 28 668 50 Property Carrying Costs 5 - 5 - Depreciation and Amortization Expense 3,877 3,626 7,760 7,194 General and Administrative Expenses: Compensation Expense 670 1,150 1,875 2,385 Professional Fees 197 243 803 645 Other General and Administrative Expenses 554 455 964 873 Total General and Administrative Expenses 1,421 1,848 3,642 3,903 Total Expenses 5,344 5,502 12,075 11,147 Loss on Sale of Real Estate (34) - (34) - Provision for Current Expected Credit Loss 10 12 23 26 Income From Operations 7,564 6,965 14,056 13,942 Other Income (Expense): 91 81 177 181 Interest Expense (210) (128) (384) (211) Total Other Income (Expense) (119) (47) (207) (30) Net Income 7,445 6,918 13,849 13,912 Net Income Attributable to Noncontrolling Interests (126) (122) (234) (247) Net Income Attributable to Common Stockholders 7,319 $6,796 13,615 $13,665 Net Income Attributable to Common Stockholders Per Share - Basic $0.36 $0.33 $0.66 $0.66 Net Income Attributable to Common Stockholders Per Share - Diluted $0.35 $0.33 $0.66 $0.66 Weighted Average Shares of Common Stock Outstanding – Basic 20,613,866 20,555,362 20,602,635 20,548,601 Weighted Average Shares of Common Stock Outstanding - Diluted 20,974,923 20,951,379 20,971,160 20,946,805

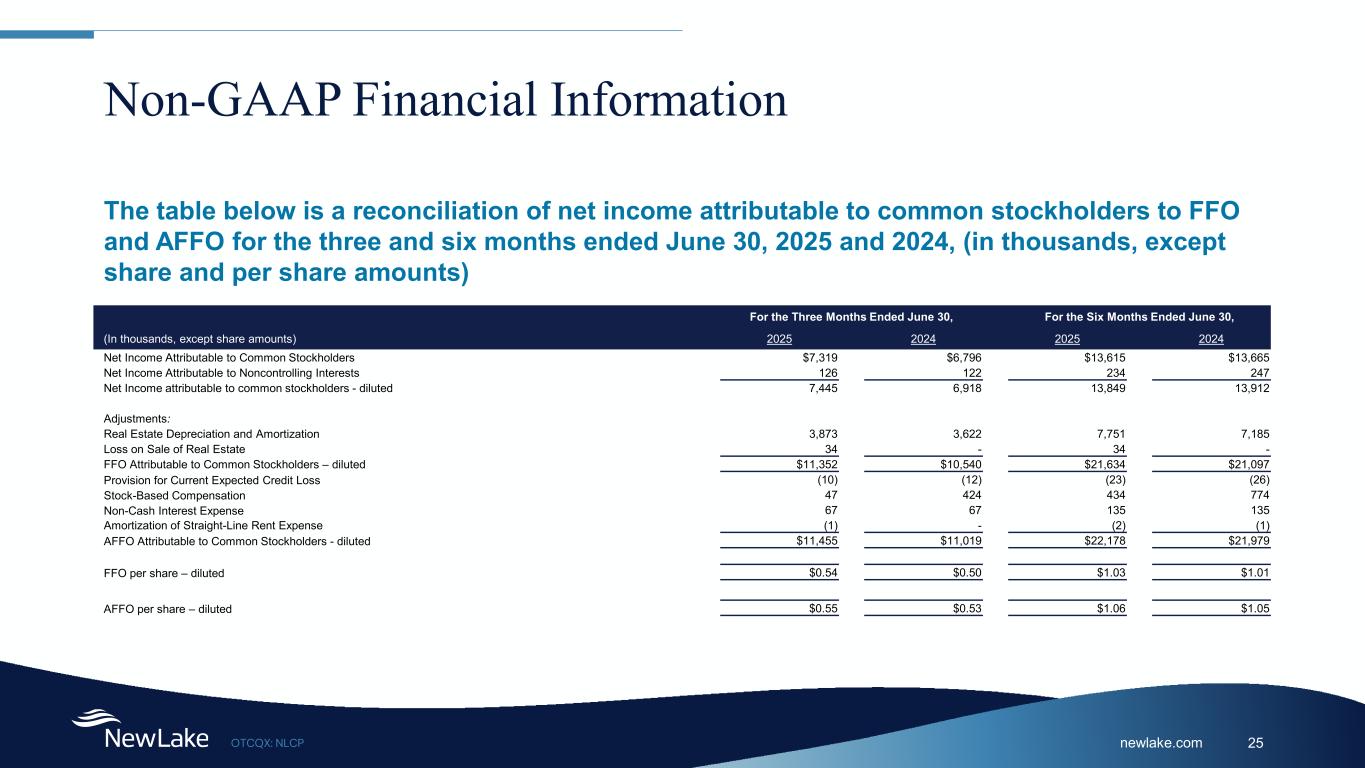

newlake.comOTCQX: NLCP 25 Non-GAAP Financial Information The table below is a reconciliation of net income attributable to common stockholders to FFO and AFFO for the three and six months ended June 30, 2025 and 2024, (in thousands, except share and per share amounts) For the Three Months Ended June 30, For the Six Months Ended June 30, (In thousands, except share amounts) 2025 2024 2025 2024 Net Income Attributable to Common Stockholders $7,319 $6,796 $13,615 $13,665 Net Income Attributable to Noncontrolling Interests 126 122 234 247 Net Income attributable to common stockholders - diluted 7,445 6,918 13,849 13,912 Adjustments: Real Estate Depreciation and Amortization 3,873 3,622 7,751 7,185 Loss on Sale of Real Estate 34 - 34 - FFO Attributable to Common Stockholders – diluted $11,352 $10,540 $21,634 $21,097 Provision for Current Expected Credit Loss (10) (12) (23) (26) Stock-Based Compensation 47 424 434 774 Non-Cash Interest Expense 67 67 135 135 Amortization of Straight-Line Rent Expense (1) - (2) (1) AFFO Attributable to Common Stockholders - diluted $11,455 $11,019 $22,178 $21,979 FFO per share – diluted $0.54 $0.50 $1.03 $1.01 AFFO per share – diluted $0.55 $0.53 $1.06 $1.05

newlake.comOTCQX: NLCP 26 Capital Commitments As of June 30, 2025(1) Tenant Location Site Type Amount C3 Connecticut Cultivation $11,043 Cresco Labs Ohio Dispensary $375 Cresco Labs Ohio Dispensary $705 Total $12,123 (1) $’s in thousands

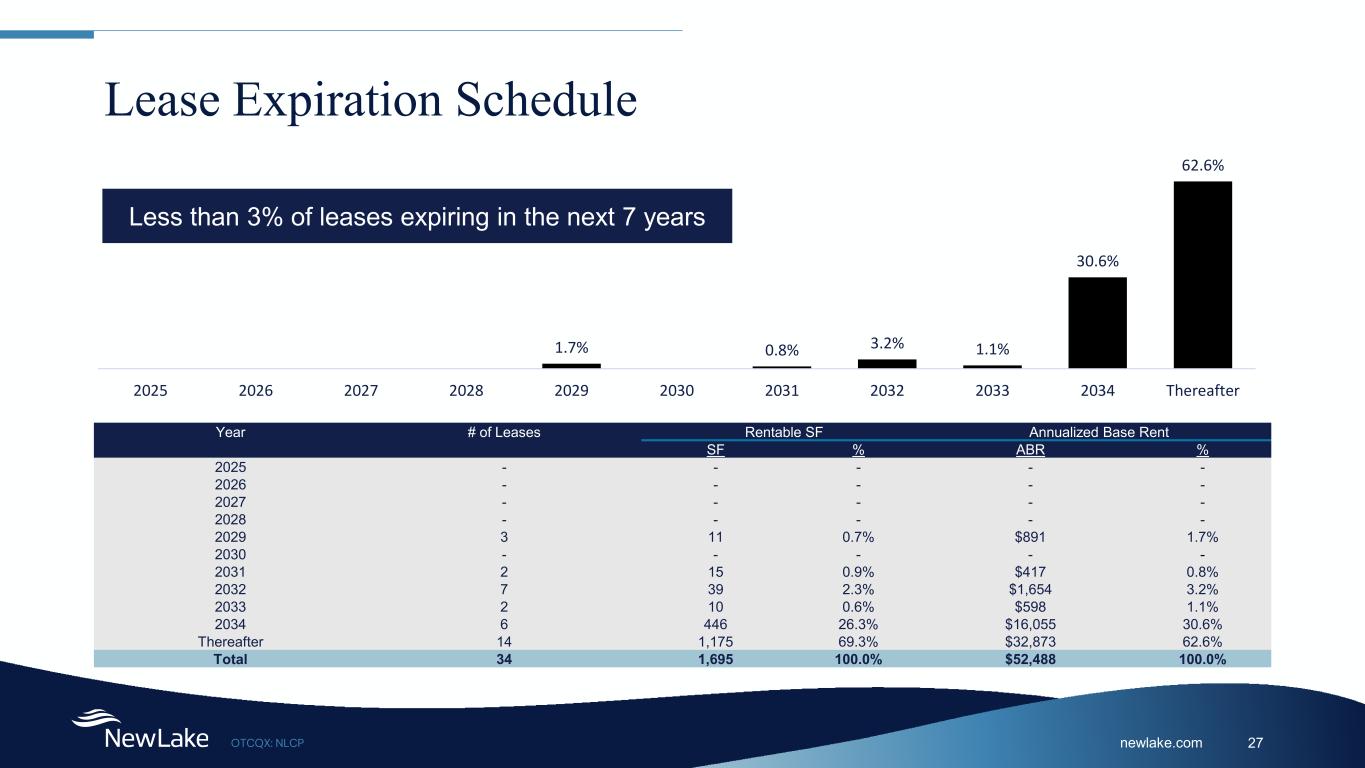

newlake.comOTCQX: NLCP 27 Lease Expiration Schedule 1.7% 0.8% 3.2% 1.1% 30.6% 62.6% 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Thereafter Less than 3% of leases expiring in the next 7 years Year # of Leases Rentable SF Annualized Base Rent SF % ABR % 2025 - - - - - 2026 - - - - - 2027 - - - - - 2028 - - - - - 2029 3 11 0.7% $891 1.7% 2030 - - - - - 2031 2 15 0.9% $417 0.8% 2032 7 39 2.3% $1,654 3.2% 2033 2 10 0.6% $598 1.1% 2034 6 446 26.3% $16,055 30.6% Thereafter 14 1,175 69.3% $32,873 62.6% Total 34 1,695 100.0% $52,488 100.0%

newlake.comOTCQX: NLCP 28 Cultivation Property List Tenant State City Date Acquired % Leased Square Feet Invested / Committed Capital $ In Place Under Development Invested Committed Total $ Total $ PSF Acreage Massachusetts Sterling 10/31/2019 100% 38,380 $9,787,999 - $9,787,999 $255 Acreage Pennsylvania Sinking Springs 10/31/2019 100% 30,625 $10,158,372 - $10,158,372 $332 Ayr Wellness Pennsylvania Pottsville 6/30/2022 100% 38,031 $15,278,586 - $15,278,586 $402 Ayr Wellness Nevada Sparks 6/30/2022 100% 56,536 $13,578,804 - $13,578,804 $240 C3 Industries Connecticut East Hartford 5/8/2024 100% - 58,436 $4,973,093 $11,043,442 $16,016,536 $274 C3 Industries Missouri O'Fallon 4/1/2022 100% 94,570 $34,000,000 - $34,000,000 $360 Calypso Pennsylvania Erie 11/1/2021 100% 99,163 $32,013,378 - $32,013,378 $323 The Cannabist Company Illinois Aurora 12/23/2019 100% 32,802 $11,469,139 - $11,469,139 $350 The Cannabist Company Massachusetts Lowell 12/23/2019 100% 38,890 $14,777,302 - $14,777,302 $380 Cresco Labs Illinois Lincoln 12/31/2019 100% 222,455 $50,677,821 - $50,677,821 $228 Curaleaf Florida Mt. Dora 8/31/21 100% 417,350 $75,983,217 - $75,983,217 $182 CODES(1) Missouri Chaffee 12/20/2021 100% 81,808 $21,132,965 $21,132,965 $258 Mint Arizona Phoenix 3/30/2021 100% 100,758 $21,815,268 - $21,815,268 $209 Revolutionary Clinics(2) Massachusetts Fitchburg 6/30/2021 100% 145,852 $42,275,000 - $42,275,000 $290 Trulieve Pennsylvania Mckeesport 10/31/2019 100% 144,602 $41,500,000 - $41,500,000 $287 (1) Previously Organic Remedies (2) Tenant vacated premise mid-July

newlake.comOTCQX: NLCP 29 Dispensary Property List Tenant State City Date Acquired % Leased Square Feet Invested / Committed Capital $ In Place Under Development Total Invested Total Committed Total $ Total $ PSF Budr(1) Connecticut Uncasville 10/31/2019 100% 2,872 $925,751 $322 The Cannabist Company Illinois Chicago 12/23/2019 100% 4,736 $1,127,931 $238 The Cannabist Company Massachusetts Greenfield 12/23/2019 100% 4,290 $2,108,951 $492 The Cannabist Company California San Diego 12/23/2019 100% 2,470 $4,581,419 $1,855 Cresco Labs Ohio Proctorville 2/19/2025 100% - 5,807 $285,000 $705,000 $990,000 $171 Cresco Labs Ohio Bridgeport 4/25/25 100% - 3,508 $500,000 $375,000 $875,000 $223 Curaleaf Illinois Chicago 1/31/2021 100% 5,040 $3,152,185 $625 Curaleaf North Dakota Minot 1/31/2021 100% 4,590 $2,011,530 $438 Curaleaf Connecticut Groton 2/28/2020 100% 11,181 $2,773,755 $248 Curaleaf Pennsylvania King of Prussia 1/31/2020 100% 1,968 $1,752,788 $891 Curaleaf Pennsylvania Brookville 6/12/2025 100% 4,167 $963,811 $231 Curaleaf Illinois Litchfield 1/31/2020 100% 1,851 $540,700 $292 Curaleaf Illinois Morris 1/31/2020 100% 6,100 $1,567,005 $257 Curaleaf Ohio Newark 2/28/2020 100% 7,200 $3,207,606 $446 Curaleaf Pennsylvania Morton 2/28/2020 100% 3,500 $2,111,999 $603 CODES(2) Arkansas Little Rock 1/31/2020 100% 7,592 $1,964,801 $259 PharmaCann Pennsylvania Shamokin 2/28/2020 100% 3,481 $1,200,000 $345 PharmaCann Massachusetts Shrewsbury 2/28/2020 100% 11,116 $1,900,000 $171 PharmaCann Ohio Wapakoneta 11/4/2022 100% 3,735 $1,550,000 $415 (1) Previously owned by Acreage; new tenant guaranteed by GTI (2) Previously owned by Greelight

Thank You Company Contact: Lisa Meyer CFO, Treasurer and Secretary Lmeyer@newlake.com Investor Relations Contact: Valter Pinto / Jack Perkins KCSA Strategic Communications NewLake@KCSA.com (212) 896-1254