Leading Provider of Real Estate Capital to U.S. Cannabis Operators November 10, 2022 OTCQX: NLCP King of Prussia, PA Aurora, IL San Diego, CA

OTCQX: NLCP This presentation has been prepared by the NewLake Capital Partners, Inc. (“we,” “us” or the “Company”) solely for informational purposes. This presentation and related discussion shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of securities. This presentation contains forward‐looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts, and are often indicated by words such as “anticipates,” estimates,” “expects,” “intends,” “plans,” “believes” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” “and “could.” Forward looking statements include, among others, statements relating to the Company’s future financial performance, business prospects and strategy, the use of proceeds from our initial public offering, future dividend payments, anticipated financial position, the Company’s acquisition pipeline, liquidity and capital needs and other similar matters. These statements are based on the Company’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. The Company’s actual results may differ materially from those expressed in, or implied by, the forward looking statements. The Company is providing the information contained herein as of the date of this presentation. Except as required by applicable law, the Company does not plan to update or revise any statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. 2 Safe Harbor Statement Aurora, IL McKeesport, PA

OTCQX: NLCP Executive Summary Leading provider of real estate capital to state-licensed cannabis operators 3 Experience • Founded in 2019 • Real estate, Cannabis, Financial services • Track record of creating significant value for investors Scale • 31 properties • 12 states • 1.7M square feet4 • $421.6M4 of committed capital • Over $4.5B of transactions reviewed Quality Portfolio • 100% leased • No defaults or deferrals • 92% cultivation, 8% retail5 • 14.9-year weighted avg. lease term • 12.2% weighted avg. yield Strong Financials • $3.0M1 in debt • $45.0M in cash • $1.48 annualized Q3 20222 dividend • $90M revolving credit facility3 High Growth • Cannabis industry • Dividend increases • 2.7% weighted avg. in place rent escalations • $84M committed4 through Q3 of 2022 Note: Data as of September 30, 2022, unless otherwise noted 1 $2.0 million of seller financing and $1 million draw on our revolving credit facility executed in May 2022. 2 Annualized based on Q3 2022 dividend of $0.37 declared on September 15, 2022. 3 $1 million drawn as of September 30, 2022. 4 Includes an option but not an obligation to purchase an adjacent parcel for $16.5 million to expand a cultivation property. 5 Calculation is based on fully committed capital

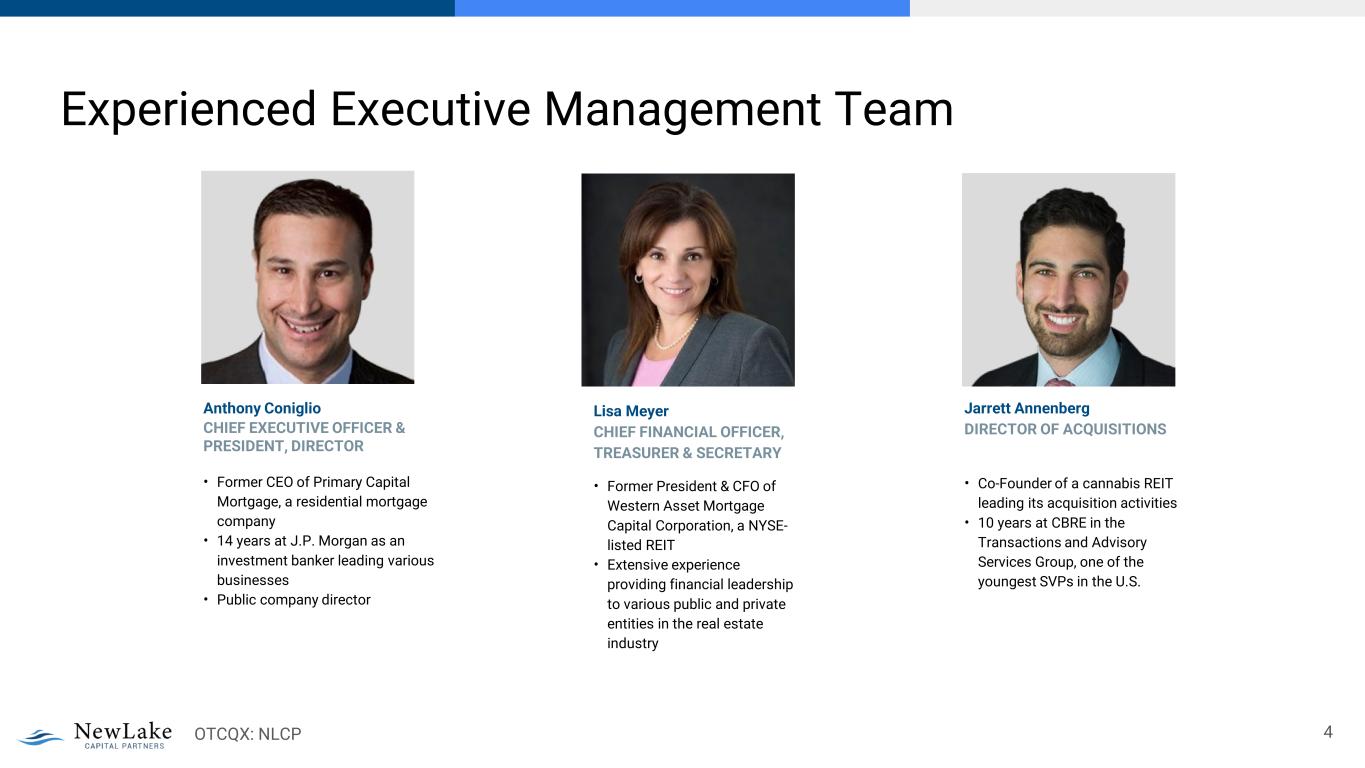

OTCQX: NLCP Experienced Executive Management Team 4 Anthony Coniglio CHIEF EXECUTIVE OFFICER & PRESIDENT, DIRECTOR • Former CEO of Primary Capital Mortgage, a residential mortgage company • 14 years at J.P. Morgan as an investment banker leading various businesses • Public company director Lisa Meyer CHIEF FINANCIAL OFFICER, TREASURER & SECRETARY • Former President & CFO of Western Asset Mortgage Capital Corporation, a NYSE- listed REIT • Extensive experience providing financial leadership to various public and private entities in the real estate industry Jarrett Annenberg DIRECTOR OF ACQUISITIONS • Co-Founder of a cannabis REIT leading its acquisition activities • 10 years at CBRE in the Transactions and Advisory Services Group, one of the youngest SVPs in the U.S.

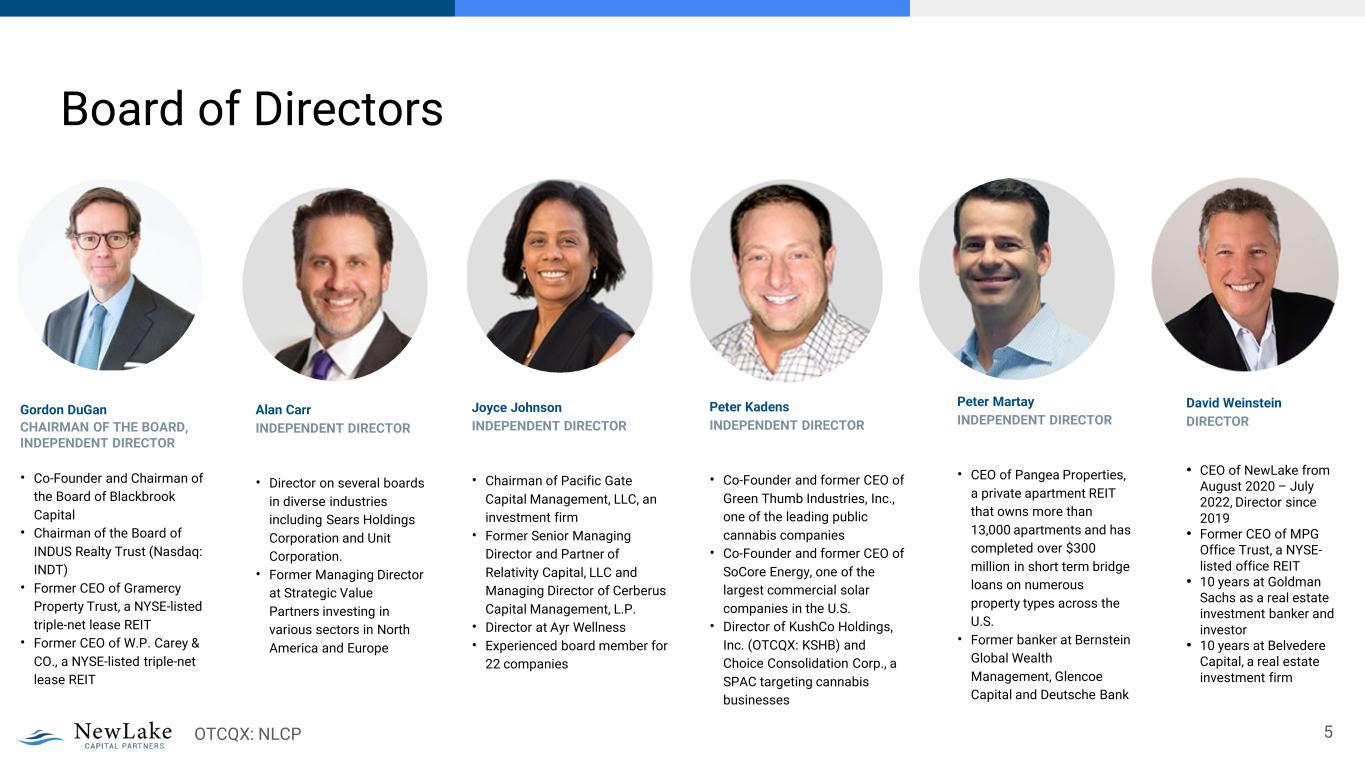

OTCQX: NLCP Board of Directors 5 Gordon DuGan CHAIRMAN OF THE BOARD, INDEPENDENT DIRECTOR • Co-Founder and Chairman of the Board of Blackbrook Capital • Chairman of the Board of INDUS Realty Trust (Nasdaq: INDT) • Former CEO of Gramercy Property Trust, a NYSE-listed triple-net lease REIT • Former CEO of W.P. Carey & CO., a NYSE-listed triple-net lease REIT Alan Carr INDEPENDENT DIRECTOR • Director on several boards in diverse industries including Sears Holdings Corporation and Unit Corporation. • Former Managing Director at Strategic Value Partners investing in various sectors in North America and Europe Joyce Johnson INDEPENDENT DIRECTOR • Chairman of Pacific Gate Capital Management, LLC, an investment firm • Former Senior Managing Director and Partner of Relativity Capital, LLC and Managing Director of Cerberus Capital Management, L.P. • Director at Ayr Wellness • Experienced board member for 22 companies Peter Kadens INDEPENDENT DIRECTOR • Co-Founder and former CEO of Green Thumb Industries, Inc., one of the leading public cannabis companies • Co-Founder and former CEO of SoCore Energy, one of the largest commercial solar companies in the U.S. • Director of KushCo Holdings, Inc. (OTCQX: KSHB) and Choice Consolidation Corp., a SPAC targeting cannabis businesses Peter Martay INDEPENDENT DIRECTOR • CEO of Pangea Properties, a private apartment REIT that owns more than 13,000 apartments and has completed over $300 million in short term bridge loans on numerous property types across the U.S. • Former banker at Bernstein Global Wealth Management, Glencoe Capital and Deutsche Bank David Weinstein DIRECTOR • CEO of NewLake from August 2020 – July 2022, Director since 2019 • Former CEO of MPG Office Trust, a NYSE- listed office REIT • 10 years at Goldman Sachs as a real estate investment banker and investor • 10 years at Belvedere Capital, a real estate investment firm

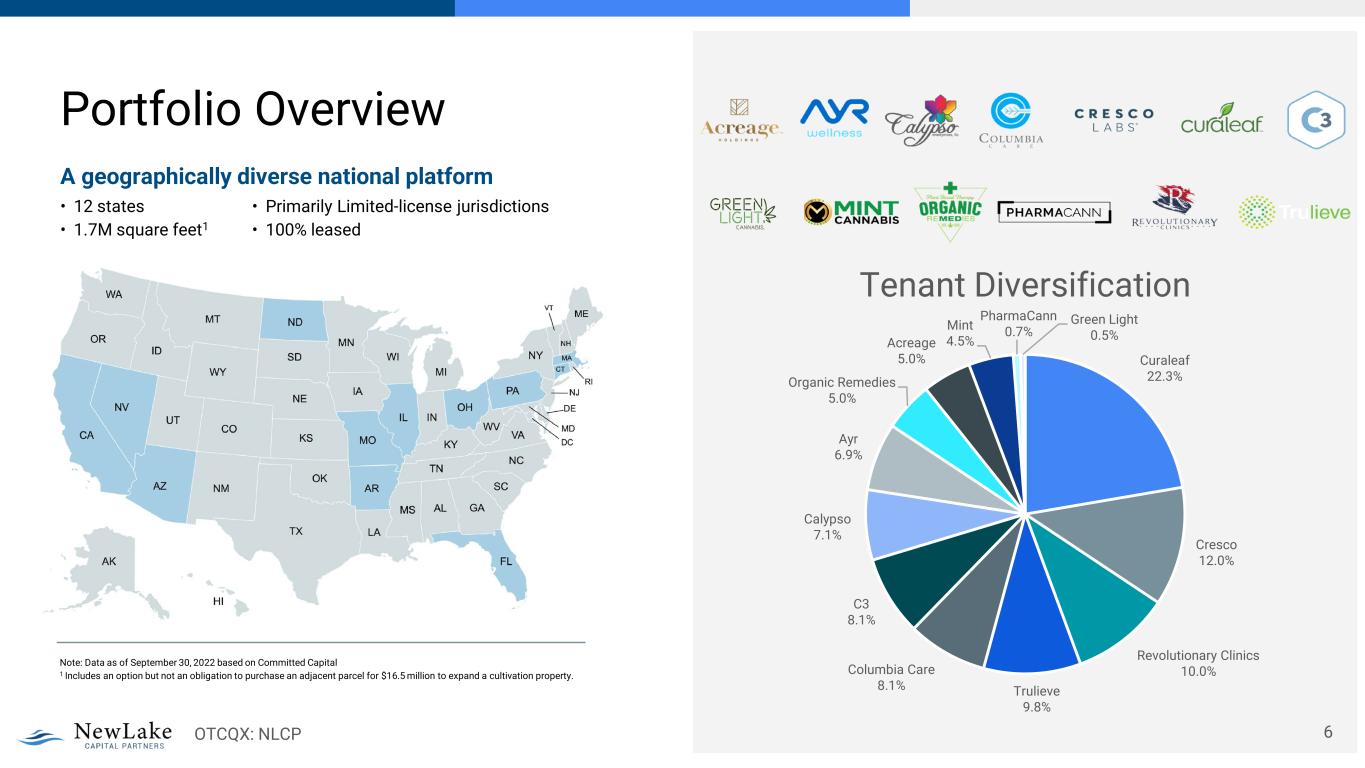

OTCQX: NLCP Portfolio Overview 6 A geographically diverse national platform • 12 states • 1.7M square feet1 • Primarily Limited-license jurisdictions • 100% leased Note: Data as of September 30, 2022 based on Committed Capital 1 Includes an option but not an obligation to purchase an adjacent parcel for $16.5 million to expand a cultivation property. Curaleaf 22.3% Cresco 12.0% Revolutionary Clinics 10.0% Trulieve 9.8% Columbia Care 8.1% C3 8.1% Calypso 7.1% Ayr 6.9% Organic Remedies 5.0% Acreage 5.0% Mint 4.5% PharmaCann 0.7% Green Light 0.5% Tenant Diversification

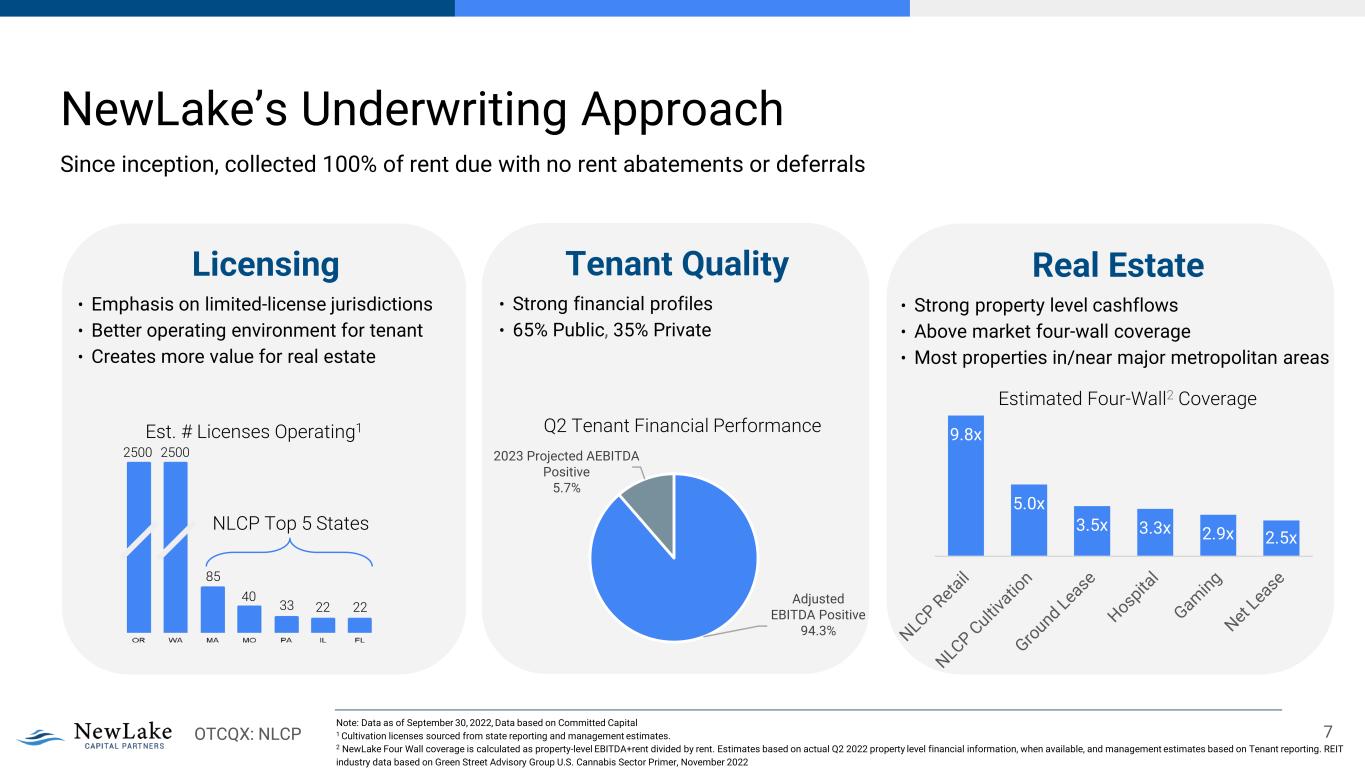

OTCQX: NLCP NewLake’s Underwriting Approach Since inception, collected 100% of rent due with no rent abatements or deferrals 7 Tenant Quality • Strong financial profiles • 65% Public, 35% Private Real Estate • Strong property level cashflows • Above market four-wall coverage • Most properties in/near major metropolitan areas Licensing • Emphasis on limited-license jurisdictions • Better operating environment for tenant • Creates more value for real estate Note: Data as of September 30, 2022, Data based on Committed Capital 1 Cultivation licenses sourced from state reporting and management estimates. 2 NewLake Four Wall coverage is calculated as property-level EBITDA+rent divided by rent. Estimates based on actual Q2 2022 property level financial information, when available, and management estimates based on Tenant reporting. REIT industry data based on Green Street Advisory Group U.S. Cannabis Sector Primer, November 2022 85 40 33 22 22 Est. # Licenses Operating1 2500 2500 NLCP Top 5 States Q2 Tenant Financial Performance Adjusted EBITDA Positive 94.3% 2023 Projected AEBITDA Positive 5.7% Estimated Four-Wall2 Coverage 9.8x 5.0x 3.5x 3.3x 2.9x 2.5x

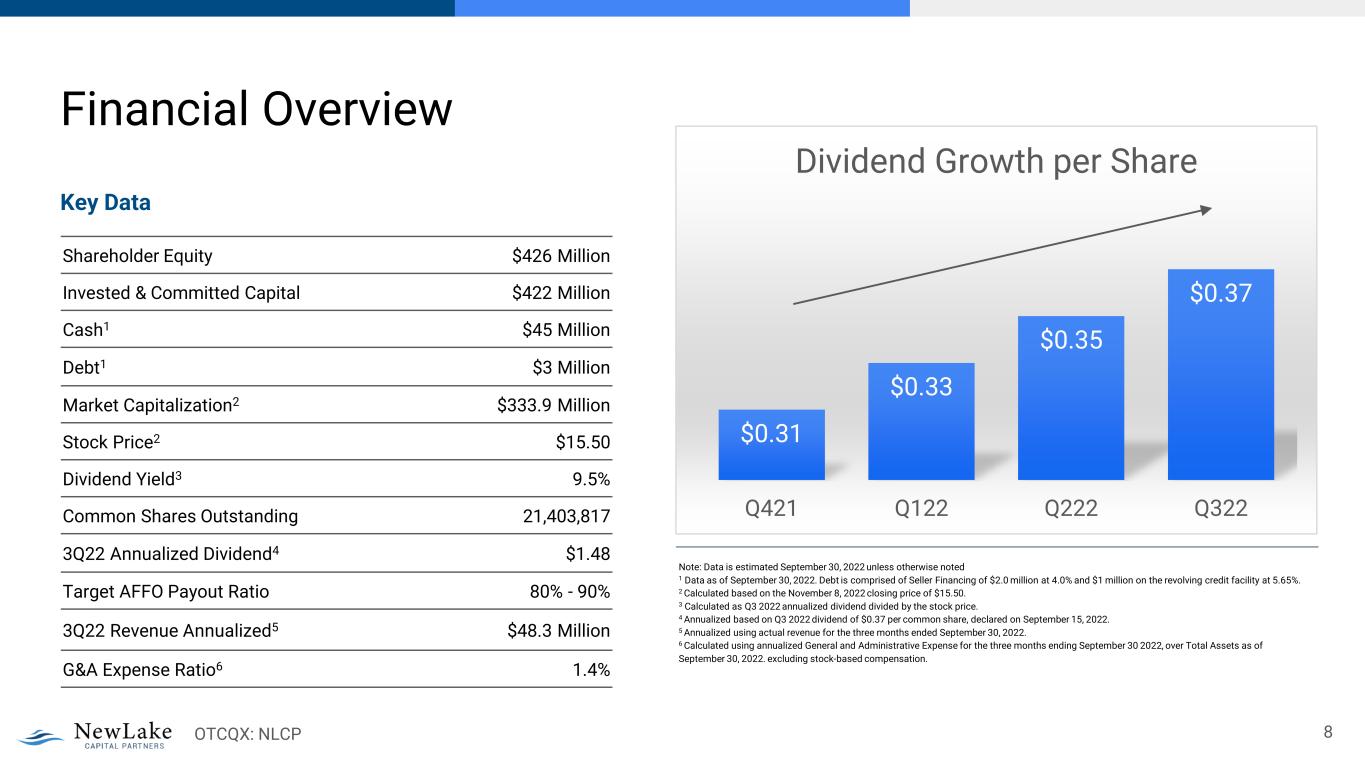

OTCQX: NLCP Financial Overview 8 Shareholder Equity $426 Million Invested & Committed Capital $422 Million Cash1 $45 Million Debt1 $3 Million Market Capitalization2 $333.9 Million Stock Price2 $15.50 Dividend Yield3 9.5% Common Shares Outstanding 21,403,817 3Q22 Annualized Dividend4 $1.48 Target AFFO Payout Ratio 80% - 90% 3Q22 Revenue Annualized5 $48.3 Million G&A Expense Ratio6 1.4% Key Data Note: Data is estimated September 30, 2022 unless otherwise noted 1 Data as of September 30, 2022. Debt is comprised of Seller Financing of $2.0 million at 4.0% and $1 million on the revolving credit facility at 5.65%. 2 Calculated based on the November 8, 2022 closing price of $15.50. 3 Calculated as Q3 2022 annualized dividend divided by the stock price. 4 Annualized based on Q3 2022 dividend of $0.37 per common share, declared on September 15, 2022. 5 Annualized using actual revenue for the three months ended September 30, 2022. 6 Calculated using annualized General and Administrative Expense for the three months ending September 30 2022, over Total Assets as of September 30, 2022. excluding stock-based compensation. $0.31 $0.33 $0.35 $0.37 Q421 Q122 Q222 Q322 Dividend Growth per Share

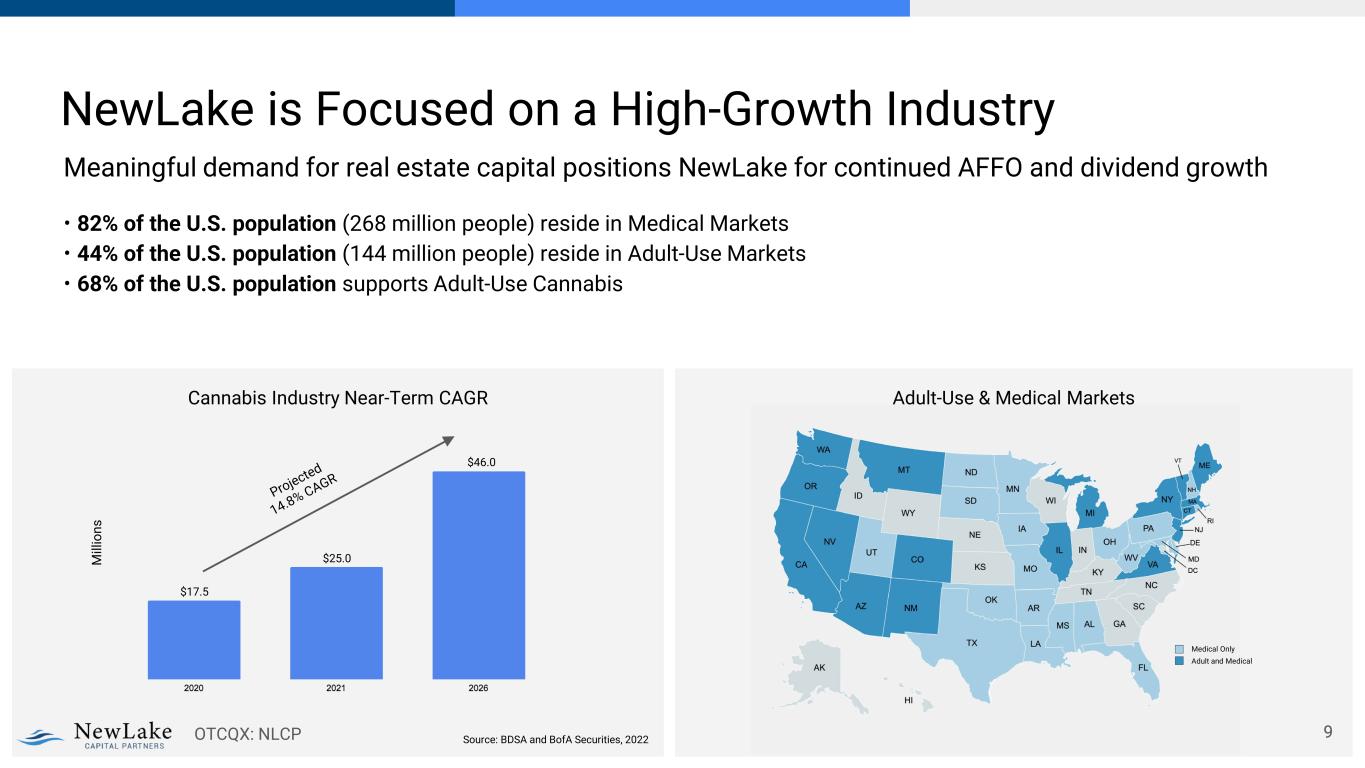

OTCQX: NLCP Adult-Use & Medical MarketsCannabis Industry Near-Term CAGR NewLake is Focused on a High-Growth Industry Meaningful demand for real estate capital positions NewLake for continued AFFO and dividend growth • 82% of the U.S. population (268 million people) reside in Medical Markets • 44% of the U.S. population (144 million people) reside in Adult-Use Markets • 68% of the U.S. population supports Adult-Use Cannabis 9 M ill io ns $17.5 $25.0 $46.0 Source: BDSA and BofA Securities, 2022 Medical Only Adult and Medical

OTCQX: NLCP Investment Highlights Experienced Team Experienced team with a track record of strong corporate governance and delivering returns for investors Scale and Early Mover NewLake’s scale and early mover advantage positions the Company for long- term success Exceptional Portfolio High-quality portfolio with significant duration and above-market yields Financial Position Solid financial position with significant financial flexibility High-Growth Focus Focus on a high-growth industry with meaningful demand for real estate capital positions NewLake to continue growing AFFO and dividends 10King of Prussia, PA

11 OTCQX: NLCP Investor Relations Contact: Valter Pinto or Jack Perkins KCSA STRATEGIC COMMUNICATIONS NewLake@KCSA.com (212) 896-1254 Company Contact: Lisa Meyer CFO, Treasurer and Secretary Lmeyer@newlake.com