UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under Rule 14a-12

NEWLAKE CAPITAL PARTNERS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

27 Pine Street, Suite 50

New Canaan, CT 06840

April 22, 2022

Dear Fellow Stockholders:

On behalf of the board of directors and management, I cordially invite you to attend the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of NewLake Capital Partners, Inc. (the “Company”, “NLCP” or “NewLake”). The Company’s principal executive office is located at 27 Pine Street, Suite 50, New Canaan, CT 06840. The Annual Meeting will be held at 11:00 a.m. Eastern Time on June 7, 2022 through a virtual web conference at www.virtualshareholdermeeting.com/NLCP2022. You will be able to attend the Annual Meeting online, vote your shares electronically, and submit questions during the meeting by logging into the website listed above using the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card, or on any additional voting instructions accompanying these proxy materials. We recommend that you log in a few minutes before the meeting to ensure you are admitted when the meeting starts.

We have included with this letter a proxy statement that provides you with detailed information about the Annual Meeting. We encourage you to read the entire proxy statement carefully. You may also obtain more information about NewLake from documents we have filed with the Securities and Exchange Commission (the “SEC”).

We are delivering our proxy statement and annual report pursuant to the SEC rules that allow companies to furnish proxy materials to their stockholders over the Internet. We believe that this delivery method expedites stockholders’ receipt of proxy materials and lowers the cost and environmental impact of our Annual Meeting. On or about April 22, 2022, we will mail to our stockholders a notice containing instructions on how to access our proxy materials. In addition, the notice includes instructions on how you can receive a paper copy of our proxy materials.

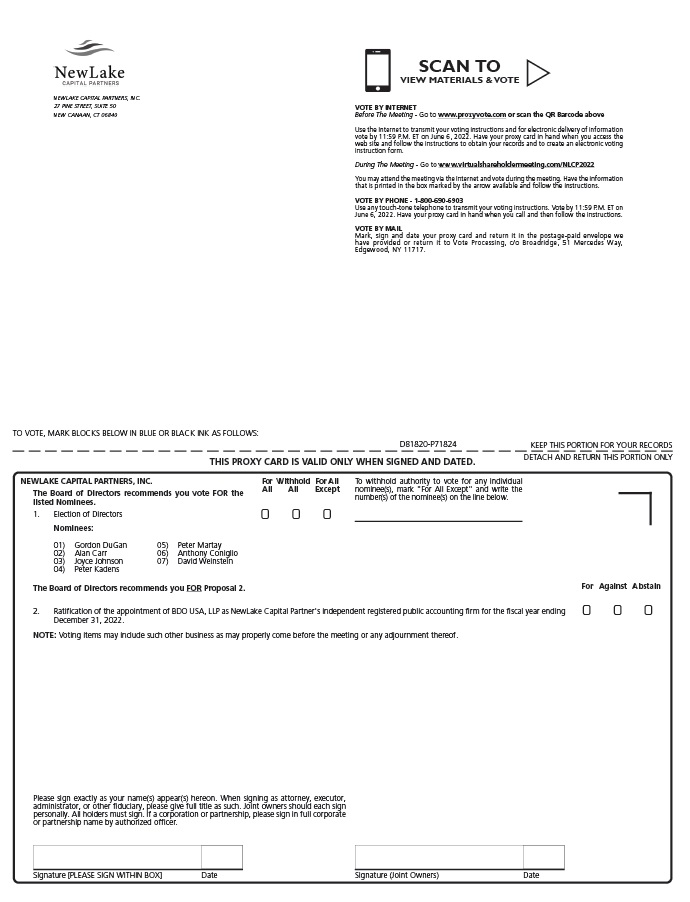

You are being asked at the Annual Meeting to elect directors named in this proxy statement, to ratify the retention of BDO USA, LLP as our independent registered public accounting firm and to transact any other business properly brought before the meeting.

Your vote is important. We encourage you to vote your shares prior to the Annual Meeting. You may vote your shares through one of the methods described in the enclosed proxy statement. We strongly urge you to read the accompanying proxy statement carefully and to vote FOR the nominees proposed by the board of directors and in accordance with the recommendations of the board of directors on the other proposals by following the voting instructions contained in the proxy statement.

On behalf of the board of directors, we thank you for your ongoing support and investment in our Company.

Sincerely,

David Weinstein

Chief Executive Officer and Director

27 Pine Street, Suite 50

New Canaan, CT 06840

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

|

TIME AND DATE |

11:00 a.m. (Eastern Time) on June 7, 2022 |

|

Online check in will be available beginning 10:45a.m. (Eastern Time). Please allow ample time for the on-line check-in process. |

|

|

PLACE |

Our Annual Meeting will be held through a virtual web conference at www.virtualshareholdermeeting.com/NLCP2022. To participate in the Annual Meeting, you will need your 16-digit control number included in your Notice of Internet Availability of the Proxy Materials, on your proxy card, or any additional voting instructions accompanying these proxy materials. |

|

ITEMS OF BUSINESS |

(1) To consider and vote upon the election of seven directors nominated by our board of directors, each to serve until the 2023 Annual Meeting and until his or her successor is duly elected and qualifies;

(2) To consider and vote upon the ratification of the appointment of BDO USA, LLP as the independent registered public accounting firm for NLCP for the fiscal year ending December 31, 2022; and

(3) To transact such other business as may properly be brought before the Annual Meeting and any adjournment, postponement or continuation thereof. |

|

|

|

| RECORD DATE | In order to vote, you must have been a stockholder of record at the close of business on April 11, 2022 (the “Record Date”) or a holder of a valid proxy from a stockholder of record as of the Record Date. |

| HOW TO VOTE: | IT IS IMPORTANT THAT YOUR SHARES ARE REPRESENTED AT THIS ANNUAL MEETING. EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, WE HOPE THAT YOU WILL PROMPTLY VOTE AND SUBMIT YOUR PROXY BY TELEPHONE, MAIL OR VIA THE INTERNET, AS DESCRIBED IN THE PROXY STATEMENT. THIS WILL NOT LIMIT YOUR RIGHTS TO ATTEND OR VOTE AT THE ANNUAL MEETING. |

By Order of the board of directors,

Fredric Starker

Chief Financial Officer, Treasurer and Secretary

Date: April 22, 2022

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 7, 2022. |

|

We are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. By doing so, we save costs and reduce the environmental impact of our Annual Meeting. We will mail a Notice of Internet Availability of Proxy Materials to certain of our stockholders. This Notice contains instructions about how to access our proxy materials and vote online or vote by telephone. If you would like to receive a paper copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. |

PROXY STATEMENT

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 7, 2022:

The Proxy Statement and the Annual Report on Form 10-K for the year ended December 31, 2021 are also available on NewLake Capital Partners, Inc.’s website, https://www.newlake.com. Information on or connected to this website is not deemed to be a part of this Proxy Statement.

TABLE OF CONTENTS

|

Page |

|

|

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING |

1 |

|

PROPOSAL NO. 1. ELECTION OF DIRECTORS |

6 |

|

Nominees for Election |

6 |

|

Commitment to Good Corporate Governance |

8 |

| Director Criteria and Qualifications | 9 |

|

Director Independence |

9 |

|

Role of the Board of Directors in Risk Oversight |

9 |

|

Board Leadership Structure |

9 |

|

Corporate Governance Guidelines |

10 |

| Board Committees | 10 |

|

Annual Board Evaluations |

12 |

|

Anti-Hedging Policy |

12 |

|

Code of Business Conduct and Ethics |

12 |

|

Clawback Policy |

12 |

|

Corporate Responsibility and Sustainability |

13 |

|

Environmental Responsibility |

13 |

|

Social Responsibility |

13 |

|

Corporate Governance |

13 |

|

Human Capital Resource Management |

13 |

|

Covid-19 Health and Safety |

14 |

|

Communications with the Board of Directors |

14 |

|

PROPOSAL NO. 2. RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

15 |

| Audit Fees | 15 |

|

Audit Committee Report |

16 |

|

OTHER MATTERS |

17 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

18 |

|

EXECUTIVE OFFICERS |

20 |

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS |

21 |

| Review, Approval or Ratification of Transactions with Related Persons | 21 |

| Investor Rights Agreement | 21 |

| Grant of Option to Purchase Shares of our Common Stock | 21 |

| Registration Rights | 21 |

| Employment Agreements | 21 |

|

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION |

22 |

|

Compensation of Named Executive Officers |

22 |

|

Base Salary |

22 |

|

Annual Cash Bonuses |

22 |

| Equity-Based Awards | 22 |

| Summary Compensation Table | 23 |

|

Comprehensive Compensation Policy |

25 |

|

Cash Compensation |

25 |

|

Outstanding Equity Awards at Fiscal Year-End |

25 |

|

Employment Agreements of our Current Named Executive Officers |

26 |

|

Director Compensation |

28 |

|

Director Compensation Program |

29 |

|

Equity Compensation Plan Information |

30 |

|

STOCKHOLDER PROPOSALS AND NOMINATIONS |

31 |

|

ANNUAL REPORT ON FORM 10-K |

32 |

2022 ANNUAL MEETING OF STOCKHOLDERS

NewLake Capital Partners, Inc. is furnishing this Proxy Statement in connection with our solicitation of proxies to be voted at our 2022 Annual Meeting of Stockholders (the “Annual Meeting”). The meeting will be held on June 7, 2022, at 11:00am Eastern Standard Time. The Annual Meeting will be a completely ‘‘virtual meeting’’ of stockholders. You will be able to attend the Annual Meeting as well as vote and submit your questions during the live webcast of the meeting by visiting (www.virtualshareholdermeeting.com/NLCP2022) and entering the 16‐digit control number included in our notice of Internet availability of the proxy materials, on your proxy card or in the instructions that accompanied your proxy materials. We are providing this Proxy Statement and the enclosed proxy card to our stockholders commencing on or about April 22, 2022.

Unless the context suggests otherwise, references in this Proxy Statement to “NewLake,” “NLCP,” “Company,” “we,” “us” and “our” are to NewLake Capital Partners, Inc., a Maryland corporation, together with our consolidated subsidiaries, including NLCP Operating Partnership, LP, a Delaware limited partnership of which we are the sole general partner and through which we conduct substantially all of our business (our “Operating Partnership”).

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, our stockholders will be asked to consider and act upon the following matters:

|

• |

The election of seven directors nominated by our board of directors and listed in this Proxy Statement to serve until the 2023 Annual Meeting and until their successors are duly elected and qualify; |

|

• |

The appointment of BDO USA, LLP as our independent registered public accounting firm for 2022; and |

|

• |

Such other business as may properly come before the Annual Meeting or any adjournment, continuation or postponement thereof. |

We completed our initial public offering (our “IPO”) in August 2021, and we qualify as (i) an “emerging growth company” as defined in Section 3(a)(80) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); and (ii) a “smaller reporting company” as defined in Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”). As a result, under Schedule 14A of the Exchange Act, we are exempt from the requirement to include in this Proxy Statement stockholder advisory votes on certain executive compensation matters, such as “say on pay” and “say on frequency” and we qualify for certain scaled executive compensation requirements applicable to emerging growth companies and smaller reporting companies.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on April 11, 2022, the record date for the Annual Meeting (the “Record Date”), or their duly authorized proxies are entitled to attend and vote at the Annual Meeting.

If you hold your shares through a bank, broker or other nominee and intend to vote in person at the Annual Meeting, you will need to provide a legal proxy from your bank, broker or other holder of record.

What are the voting rights of stockholders?

Subject to the provisions of our charter regarding the restrictions on transfer and ownership of shares of our common stock, $0.01 par value per share (our “Common Stock”), each outstanding share of Common Stock entitles the holder to one vote on all matters submitted to a vote of stockholders.

How many shares are outstanding?

At the close of business on April 11, 2022, 21,300,410 shares of common stock were issued and outstanding.

What constitutes a quorum?

The presence in person or by proxy of the stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting will constitute a quorum for the transaction of business. Abstentions and broker non-votes, if any, will be counted for purposes of determining whether a quorum is present. See "What is the effect of abstentions and broker non-votes on the proposals submitted at the Annual Meeting" below.

What is the effect of abstentions and broker non-votes on the proposals submitted at the Annual Meeting?

Abstentions and broker non-votes are each included in the determination of the number of shares present at the Annual Meeting for the purpose of determining whether a quorum is present.

An abstention is the voluntary act of directing your proxy to abstain or attending the meeting in person and marking a ballot to abstain.

A broker non-vote occurs when a nominee (i.e., a broker) holding shares for a beneficial owner has not received instructions from the beneficial owner on a particular proposal for which the nominee is not permitted to exercise discretionary voting power under certain stock exchange rules, and therefore, the nominee does not cast a vote on the proposal.

Brokers are not permitted to vote shares held in their clients’ accounts on elections of directors (which is considered a non-routine matter) unless the client (as beneficial owner) has provided voting instructions to the broker. The ratification of the appointment of our independent registered public accounting firm is, however, a proposal for which brokers do have discretionary voting authority. If you hold your shares in “street name” (i.e., through a broker or other nominee), your broker or nominee will not vote your shares on non-routine matters unless you provide instructions on how to vote your shares. You can instruct your broker or nominee how to vote your shares by following the voting procedures provided by your broker or nominee.

Abstentions do not count as votes cast on the election of directors or the ratification of the appointment of BDO USA, LLP and will have no effect on the results of such proposals.

Broker non-votes, if any, do not count as votes cast on the election of directors or the ratification of the appointment of BDO USA, LLP.

What is the difference between a “stockholder of record” and a “street name” holder?

These terms describe how your shares are held. If your shares are registered directly in your name with Equiniti Shareowner Services, our transfer agent and registrar, you are a “stockholder of record.” If your shares are held in the name of a brokerage, bank, trust or other nominee as a custodian, you are a “street name” holder.

If you are a “street name” holder, you are considered the beneficial owner of shares held in street name and your broker or nominee is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote your shares. You are also invited to attend the Annual Meeting and vote your shares; however, in order to vote your shares at out virtual Annual Meeting, you must provide us with a legal proxy from your bank, broker or other stockholder of record.

Why am I receiving these materials?

The board of directors has made these materials available to you over the internet or has delivered printed versions of these materials to you by mail, in connection with the Board’s solicitation of proxies for use at the 2022 Annual Meeting, which is scheduled to be held on June 7, 2022, at 11:00 a.m., Eastern Standard Time, via live webcast through the link. You will need the 16‐digit control number provided on the Notice of Internet Availability of Proxy Materials or your proxy card (if applicable). This solicitation is for proxies for use at the Annual Meeting or at any reconvened meeting after an adjournment or postponement of the Annual Meeting.

How can I vote my shares in person and participate at the Annual Meeting?

This year’s Annual Meeting will be held entirely online to allow greater participation. Shareholders may participate in the Annual Meeting by visiting the following website: (www.virtualshareholdermeeting.com/NLCP2022). To participate in the Annual Meeting, you will need the 16‐digit control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. Shares held in your name as the shareholder of record may be voted electronically during the Annual Meeting. Shares for which you are the beneficial owner but not the shareholder of record also may be voted electronically during the Annual Meeting. However, even if you plan to attend the Annual Meeting, the Company recommends that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting.

How can I vote my shares without attending the Annual Meeting?

To vote your shares without attending the meeting, please follow the instructions for Internet or telephone voting on the Notice. If you request printed copies of the proxy materials by mail, you may also vote by signing and submitting your proxy card and returning it by mail, if you are the stockholder of record, or by signing the voter instruction form provided by your bank or broker and returning it by mail, if you are the beneficial owner but not the stockholder of record. This way your shares will be represented whether or not you are able to attend the meeting.

What will I need in order to attend the Annual Meeting?

You are eligible to attend the virtual Annual Meeting only if you were a stockholder of record as of the record date for the Annual Meeting, or April 11, 2022 (the “Record Date”), or you hold a valid proxy for the Annual Meeting. You may attend the Annual Meeting, vote, and submit a question during the Annual Meeting by visiting (www.virtualshareholdermeeting.com/NLCP2022) and using your 16‐digit control number to enter the meeting. If you are not a stockholder of record but hold shares as a beneficial owner in street name, you may be required to provide proof of beneficial ownership, such as your most recent account statement as of the Record Date, a copy of the voting instruction form provided by your broker, bank, trustee, or nominee, or other similar evidence of ownership. If you do not comply with the procedures outlined above, you will not be admitted to the virtual Annual Meeting.

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts with our transfer agent and/or with a broker, bank or other nominee. You will need to vote separately with respect to each proxy card you received. Please vote all of the shares you own.

Can I change my vote after I have mailed in my proxy card?

You may revoke your proxy by doing one of the following:

|

• |

by sending a written notice of revocation to our Secretary at 27 Pine Street, Suite 50, New Canaan, CT 06840 so it is received prior to the meeting on June 7, 2022, stating that you revoke your proxy; |

|

• |

by signing a later-dated proxy card and submitting it so it is received prior to the meeting in accordance with the instructions included in the proxy card(s); or |

|

• |

by attending the Annual Meeting and voting your shares. Attendance at the Annual Meeting will not, by itself, revoke a duly executed proxy. |

How may I vote for each proposal?

Proposal 1 — In the election of the seven director nominees, you may vote “FOR” all nominees, “WITHOLD” your vote as to all nominees, or “FOR” all nominees except those specific nominees from whom you “WITHHOLD” your vote. If a quorum is present at the Annual Meeting, each director will be elected by the vote of a plurality of the votes cast with respect to that director nominee’s election. Under the plurality standard, the number of individuals equal to the number of directorships to be filled who receive more votes than other nominees are elected to the board, regardless of whether they receive a majority of votes cast. Abstentions and broker non-votes, if any, are not treated as votes cast and thus will have no effect on the outcome of the vote on the election of directors, although they will be considered present for the purpose of determining the presence of a quorum. Under our charter, cumulative voting is not permitted.

Proposal 2 — In the ratification of BDO USA, LLP as our independent registered public accounting firm, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If a quorum is present at the Annual Meeting, the proposal to ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for 2022 will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal. Abstentions and broker non-votes, if any, are not treated as votes cast and thus will have no effect on the outcome of the vote on this proposal, although they will be considered present for the purpose of determining the presence of a quorum.

None of the proposals, if approved, entitle stockholders to appraisal rights under Maryland law or our charter.

What are the board of directors’ recommendations on how I should vote my shares?

The board of directors unanimously recommends that you vote:

Proposal 1 — For all seven nominees for election as director.

Proposal 2 — For the proposal to ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for 2022.

What if I authorize a proxy without specifying a choice on any given matter at the Annual Meeting?

If you are a stockholder of record as of the Record Date and you properly authorize a proxy (whether by Internet or mail) without specifying a choice on any given matter to be considered at the Annual Meeting, the proxy holders will vote your shares according to the board of directors’ recommendation on that matter. If you are a stockholder of record as of the Record Date and you fail to authorize a proxy or vote in person, assuming that a quorum is present at the Annual Meeting, it will have no effect on the result of the vote on any of the matters to be considered at the Annual Meeting.

What if I hold my shares through a broker, bank or other nominee?

If you hold your shares through a broker, bank or other nominee, your broker, bank or other nominee may not vote with respect to certain proposals unless you have provided voting instructions with respect to that proposal.

What if I return my proxy card but do not provide voting instructions?

If you return a signed proxy card but do not provide voting instructions, your shares will be voted by the proxies identified in the proxy card as follows:

Proposal 1 — For all seven nominees for election as director.

Proposal 2 — For the proposal to ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for 2022.

What happens if additional matters are presented at the Annual Meeting?

We know of no other matters other than the items of business described in this Proxy Statement that can be considered at the meeting. If other matters requiring a vote do arise, the persons named as proxies will have the discretion to vote on those matters for you.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc. (“Broadridge”) will act as the inspector of election and will tabulate votes.

Who pays the cost of this proxy solicitation?

We will pay the cost of preparing, assembling and mailing the proxy materials. We have retained Broadridge to assist us in the distribution of proxy materials and the passive solicitation of proxies. We expect to pay Broadridge approximately $30,000 in the aggregate for services rendered, including passively soliciting proxies, reviewing of proxy materials, disseminating of brokers’ search cards, distributing proxy materials, operating online and phone voting systems, receiving executed proxies and tabulation of results. We will also request banks, brokers and other holders of record to send the proxy materials to, and obtain proxies from, beneficial owners and will reimburse them for their reasonable expenses in doing so.

How do I submit a stockholder proposal for inclusion in the proxy materials for next year’s Annual Meeting and what is the deadline for submitting a proposal?

Shareholder Proposals for Inclusion in 2023 Proxy Statement Pursuant to SEC Rule 14a-8. In order for a stockholder proposal to be properly submitted pursuant to Rule 14a-8 under the Exchange Act (“Rule 14a-8”) for presentation at our 2023 Annual Meeting and included in the proxy material for next year’s Annual Meeting, we must receive written notice of the proposal at our executive offices by December 23, 2022. A stockholder nomination of a person for election to our Board or a proposal for consideration at our 2023 Annual Meeting of Stockholders not intended to be included in our proxy statement pursuant to Rule 14a-8 must be submitted in accordance with the advance notice procedures and other requirements set forth in our Bylaws (our “Bylaws”).

Other Shareholder Proposals and Nominations. Pursuant to our Bylaws, we must receive timely notice of the nomination or other proposal in writing by not later than 5:00 p.m., Eastern Time, on December 23, 2022 nor earlier than November 23, 2022. However, in the event that the 2023 Annual Meeting of Stockholders is advanced or delayed by more than 30 days from the first anniversary of the date of the 2022 Annual Meeting of Stockholders, notice by the stockholder to be timely must be received no earlier than the 150th day prior to the date of the meeting and not later than 5:00 p.m., Eastern Time, on the later of the 120th day prior to the date of the meeting or the 10th day following the date of the first public announcement of the meeting.

Proposals should be sent via registered, certified or express mail to: 27 Pine Street, Suite 50 New Canaan, CT 06840 Attention: Fredric Starker, Secretary. For more information regarding stockholder proposals, see “Stockholder Proposals and Nominations” below.

If I share my residence with another stockholder, how many copies of the proxy materials should I receive?

We are sending only a single set of the proxy materials to any household at which two or more stockholders reside if they share the same last name or we reasonably believe they are members of the same family, unless we have received instructions to the contrary from any stockholder at that address. This practice is known as “householding” and is permitted by rules adopted by the SEC and Maryland law. This practice reduces the volume of duplicate information received at your household and helps us to reduce costs. Each stockholder will continue to receive a separate proxy card or voting instructions card. We will deliver promptly, upon written request or oral request, a separate copy of: (i) the Notice of 2022 Annual Meeting of Stockholders; (ii) the Proxy Statement, with the accompanying annual letter; or (iii) the Annual Report on Form 10-K for the year ended December 31, 2021 (the “Annual Report on Form 10-K”), as applicable, to a stockholder at a shared address to which a single copy of the documents were previously delivered. If you received a single set of these documents for your household for this year, but you would prefer to receive your own copy, you may direct requests for separate copies in the future to the following address: Broadridge Financial Solutions, Inc. by calling 1-866-540-7095 or in writing at 51 Mercedes Way, Edgewood, New York 11717, Attention: Householding Department. If you are a stockholder who receives multiple copies of our proxy materials, you may request householding by contacting us in the same manner and requesting a householding consent form.

What if I consent to have one set of materials mailed now but change my mind later?

You may withdraw your householding consent at any time by contacting Broadridge at the address and phone number provided above. We will begin sending separate copies of stockholders’ communications to you within 30 days of receipt of your instructions.

The reason I receive multiple sets of materials is because some of the shares belong to my children. What happens if they move out and no longer live in my household?

When we receive notice of an address change for one of the members of the household, we will begin sending separate copies of stockholder communications directly to the stockholder at his or her new address. You may notify us of a change of address by contacting Broadridge at the address and phone number provided above.

Other Information

The Annual Report on Form 10-K , which is our Annual Report to Stockholders, is available at www.sec.gov and accompanies this Proxy Statement.

The Annual Report on Form 10-K may also be accessed through our website at https://www.newlake.com by clicking on the “Investors” link. At the written request of any stockholder who owns our Common Stock as of the close of business on the Record Date, we will provide, without charge, additional paper copies of our Annual Report on Form 10-K, including the financial statements and financial statement schedule, as filed with the SEC, except exhibits thereto. If requested by eligible stockholders, we will provide copies of the exhibits for a reasonable fee. You can request copies of our Annual Report on Form 10-K by mailing a written request to:

NewLake Capital Partners, Inc.

27 Pine Street, Suite 50

New Canaan, CT 06840

Attention: Secretary

PROPOSAL NO. 1. ELECTION OF DIRECTORS

Our Bylaws provide that the number of directors shall be fixed by resolution of the board of directors, provided that there shall never be less than the minimum number required by Maryland law, nor more than 15. The board of directors has fixed the number of directors at seven. We have entered into the Investor Rights Agreement with certain of our stockholders, pursuant to which the stockholders party thereto have certain rights with respect to the nomination of members to our board of directors. All directors are elected until the next Annual Meeting of stockholders and until their successors are duly elected and qualify. The board of directors, upon the recommendation of its nominating and corporate governance committee, has nominated Gordon DuGan, Alan Carr, Anthony Coniglio, Joyce Johnson, Peter Kadens, Peter Martay and David Weinstein for election at the Annual Meeting for a term to expire at the Annual Meeting of stockholders in 2023 and until their successors are duly elected and qualify. Each nominee served on the board of directors as of the date hereof. Officers serve at the pleasure of our board of directors, subject to the terms and conditions of any employment agreements.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

EACH OF THE NOMINEES NAMED IN PROPOSAL NO. 1.

It is the intention of the persons named in the enclosed proxy, in the absence of a contrary direction, to vote for the election of all of the nominees named in Proposal No. 1. Should any of the nominees become unable or refuse to accept nomination or election as a director, the persons named as proxies intend to vote for the election of such other person as the nominating and corporate governance committee may recommend or our board of directors may reduce the number of directors to be elected at the Annual Meeting. The board of directors knows of no reason why any of the nominees might be unable or refuse to accept nomination or election.

Nominees for Election

Information is set forth below regarding each of our board of directors’ seven nominees.

|

Name |

Age |

Position(s) |

|

Gordon DuGan |

55 |

Independent Chair of the Board of Directors |

|

Alan Carr |

52 |

Independent Director |

|

Joyce Johnson |

55 |

Independent Director |

|

Peter Kadens |

44 |

Independent Director |

|

Peter Martay |

44 |

Independent Director |

|

David Weinstein |

55 |

Chief Executive Officer and Director |

|

Anthony Coniglio |

53 |

President, Chief Investment Officer and Director |

Gordon DuGan

Gordon DuGan, 55, is the Chairman of our board of directors and has served as Chairman of our board of directors since April 2019. Mr. DuGan is also the Chairman of Indus Realty Trust, a Nasdaq-listed industrial REIT. Mr. DuGan is the Co-Founder and Chairman of Blackbrook Capital, an investment fund focused on industrial and net lease investments in Europe. Mr. DuGan is the former Chief Executive Officer of Gramercy Property Trust (“Gramercy”), a formerly NYSE-listed industrial REIT, which was sold to Blackstone Equity Partners VIII, LP for $7.6 billion in October of 2018. After becoming the Chief Executive Officer of Gramercy in 2012, Mr. DuGan oversaw the growth of Gramercy from $300 million in net assets during which time Gramercy became the third best performing REIT in the U.S. Prior to his work for Gramercy, Mr. DuGan was Chief Executive Officer of W.P. Carey & Co., (“WPC”), a NYSE-listed triple-net lease REIT, from 2003 until 2010. During this time, WPC grew to $10 billion in assets, maintained its dividend during the financial crisis, and significantly outperformed the MSCI US REIT index. Mr. DuGan also founded the European investment business of both WPC and Gramercy during his tenure at those companies and oversaw over $4 billion in European investments. In addition, Mr. DuGan is a former member of the Board of Governors of NAREIT. Mr. DuGan is also a member of the Council on Foreign Relations and is the Treasurer of the Innocence Project. Mr. DuGan received a B.S. in Economics with a concentration in Finance from the Wharton School of the University of Pennsylvania.

Alan Carr

Alan Carr, 52, is a member of our board of directors, and has served as a member of our board of directors since August 2019. Beginning in 2013, Mr. Carr has served as the Co-Founder, Managing Member and Chief Executive Officer of Drivetrain LLC, Prior to co-founding Drivetrain LLC, Mr. Carr served as a Managing Director at Strategic Value Partners from 2003 to 2013, leading investments in various sectors in North America and Europe. From 1997 until 2003, Mr. Carr was a corporate attorney at Skadden, Arps, Slate, Meager & Flom and before that, at Ravin, Sarasohn, Baumgarten, Fisch & Rosen. He currently serves as a director of the following public companies: Sears Holdings Corporation and Unit Corporation. Mr. Carr has previously, and does currently, serve as a director on several other boards in diverse industries and throughout the world. Mr. Carr received a B.A. in Economics from Brandeis University and Juris Doctor, cum laude, from Tulane Law School.

Joyce Johnson

Joyce Johnson, 55, is a member of our board of directors. Ms. Johnson currently serves as Chairwoman and Chief Investment Officer for Pacific Gate Capital, a value-oriented fund of funds that focuses on U.S. private credit investments. Prior to Pacific Gate Capital, Ms. Johnson’s investment experiences include senior management positions at Citibank, ING, Relativity Capital (a women and minority owned firm) and Cerberus Capital Management, a $45 billion investment firm where she was the 2nd employee to join the firm. While employed at Cerberus, Ms. Johnson founded JJM, LLC a $300 million distressed private equity fund that successfully invested in women and minority owned companies. An experienced board member for more than 25 companies over the past 25 years, Ms. Johnson currently serves on the corporate boards of Ayr Wellness (OTCQX: AYRWF), an expanding vertically integrated, U.S. multi-state cannabis operator; Kymera International, a portfolio company of Palladium Equity Partners, a $3.3 billion private equity fund; Omaha National Insurance Company (private) an Agman Partners portfolio company; and SportsTek,(NASDAQ: SPTKU), which invests in sports and sports related technology companies. Ms. Johnson is a Henry Crown Fellow of the Aspen Institute and currently serves on the boards of the Chicago Counsel for Global Affairs, the Chicago Sinfonietta and is Chairman Emeritus of the DuSable Museum. Ms. Johnson received her BS in Finance from the University of Denver.

Peter Kadens

Peter Kadens, 44, has served as a member of our board of directors since March 2021. Beginning in August 2019, Mr. Kadens served as a member of the board of directors of the company we merged with in March 2021. Mr. Kadens joined our board of directors upon completion of the merger. Mr. Kadens currently serves as Chairman of Kadens Family Holdings, a single-family office focused on impact investments. Prior to these roles, Mr. Kadens was the Co-Founder and Chief Executive Officer of Green Thumb Industries Inc. (OTCQX: GTBIF), one of the largest publicly-traded legal cannabis operators in the U.S. Mr. Kadens also previously served as a director of the Marijuana Policy Project (MPP), the Cannabis Trade Federation (CTF), and KushCo Holdings, Inc. (OTCQX: KSHB) and previously served as a director of until its merger with Greenlane (NASDAQ: GNLN) in August 2021. Mr. Kadens currently serves as a director of Choice Consolidation Corp., a SPAC targeting the cannabis industry. In 2018, Mr. Kadens was named one of 20 People to Watch in the cannabis industry by Marijuana Business Daily. Prior to serving as Chief Executive Officer of Green Thumb Industries Inc., Mr. Kadens founded SoCore Energy, one of the largest commercial solar companies in the U.S. Under his leadership, SoCore Energy expanded operations into 17 states and was named one of Chicago’s most innovative businesses by Chicago Innovation Awards. Mr. Kadens eventually sold SoCore Energy to Edison International, a Fortune 500 energy holding company. In addition, Mr. Kadens currently serves as the Chairman of the Kadens Family Foundation, a charitable organization dedicated to closing the pervasive wealth and education gaps in the U.S.

Peter Martay

Peter Martay, 44, has served as a member of our board of directors since March 2021. Beginning in August 2019, Mr. Martay served as Chairman of the board of directors of the company we merged with in March 2021. Mr. Martay joined our board of directors upon completion of the merger. Mr. Martay is currently the Chief Executive Officer and a Director of Pangea Properties, a private REIT based in Chicago. He joined Pangea Properties in 2009 as the company’s fifth employee and the Chief Investment Officer and took over as CEO in 2017. During Mr. Martay’s tenure at Pangea Properties, he has directly overseen the acquisition of over 500 properties, totaling more than 13,000 apartments and over $1 billion in value. Mr. Martay helped create the lending division at Pangea Properties, Pangea Mortgage Capital, which has completed over $500 million in short-term bridge loans on numerous property types across the country. Prior to joining Pangea Properties, Mr. Martay served as Vice President at Bernstein Global Wealth Management from 2005 to 2009. From 2002 until 2004, Mr. Martay also worked as an associate for the Chicago-based private equity firm, Glencoe Capital. Mr. Martay started his career in investment banking at Deutsche Bank, as part of the Leveraged Finance Group, and received his BBA from the University of Michigan’s Stephen M. Ross School of Business.

David Weinstein

David Weinstein, 55, is our Chief Executive Officer and serves as a member of our board of directors. Mr. Weinstein joined our company as Chief Executive Officer in August 2020 and has served as a member of our board of directors since August 2019. In addition, Mr. Weinstein is an advisor to a partnership that is focused on the development of a 74-acre maritime port in Sunset Park, Brooklyn. Mr. Weinstein was a partner at Belvedere Capital, a real estate investment firm based in New York, from 2008 to 2013, and again from 2016 to 2020. Most recently, he focused on Belvedere’s investment in Industry City, a six million square foot redevelopment project in Sunset Park, Brooklyn. From 2017 to June 2021, Mr. Weinstein served as a member of the board of directors of Leisure Acquisition Corp., a Nasdaq listed special purpose acquisition corporation and from 2015 to 2016, Mr. Weinstein served as a member of the board of directors of Forestar Group, Inc., a NYSE-listed real estate and oil and gas company. Prior to that, Mr. Weinstein served as a member of the board of directors beginning in 2008, and as President and Chief Executive Officer beginning in 2010, of MPG Office Trust, Inc., a NYSE-listed office REIT, until the sale of the company in 2013. From 2007 to 2008, Mr. Weinstein was a Managing Director of Westbridge Investment Group/Westmont Hospitality Group, a real estate investment fund focused on hospitality. Mr. Weinstein worked at Goldman, Sachs & Co. from 1996 to 2007, first in the real estate investment banking group (focused on mergers, asset sales and corporate finance) and then in the Special Situations Group (focused on real estate debt investments). Mr. Weinstein received a B.S. in Economics, magna cum laude, with a concentration in finance, from The Wharton School of the University of Pennsylvania and a Juris Doctor, cum laude, from the University of Pennsylvania Law School. He is a member of the New York State Bar Association.

Anthony Coniglio

Anthony Coniglio, 53, is our President, Chief Investment Officer, and serves as a member of our board of directors. Mr. Coniglio joined our company and our board of directors upon completion of our merger in March 2021. Mr. Coniglio previously served as Chief Executive Officer of the company we merged with since its inception in April 2019. Prior to joining the company we merged with, Mr. Coniglio was the Chief Executive Officer of Primary Capital Mortgage Company (“PCM”), a residential mortgage company. Prior to PCM, he was a Managing Director at JPMorgan, leading various businesses, including a start-up platform, to leadership positions and helping grow business line profitability exponentially. During his 14 years at JPMorgan, Mr. Coniglio was named by Dealmaker Magazine as “Top 40 under 40 on Wall Street” and led complex transactions, such as the financial-crisis restructurings for GMAC and Chrysler Financial, as well as AmeriCredit’s $3.5 billion sale to General Motors. Mr. Coniglio has led numerous initial public offerings for REITs and corporations, including MasterCard’s $5.3 billion initial public offering. With more than 30 years of experience, Mr. Coniglio is a proven executive possessing a unique mix of skills that have allowed him to be highly successful in the context of a Fortune 100 company as well as a start-up. Mr. Coniglio is an experienced NYSE board member, serving on the audit committee and special committee of Atlas Resource Partners as an independent director. In addition, Mr. Coniglio serves on the board of St. Mary’s Hospital for Children, the largest post-acute care pediatric facility in the tri-state area, as chair of the IT & cybersecurity committee and member of the audit committee. Mr. Coniglio also serves as an Advisory Board Member, Speaker, Volunteer and coach. He was a recipient of United Hospital Fund’s 2018 Distinguished Trustee Award. Mr. Coniglio received a B.S. in Accounting and Finance from the State University of New York, College at Oneonta. Mr. Coniglio was a Certified Public Accountant during his tenure at Price Waterhouse, LLP.

Commitment to Good Corporate Governance

We believe a company’s reputation for integrity and serving its stockholders responsibly is critical. We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance structure include the following:

|

• |

Our board of directors is not classified, with each of our directors subject to re-election annually; |

|

• |

Of the seven persons who serve on our board of directors, our board of directors has determined that five of our directors satisfy the listing standards for independence of the OTCQX and Rule 10A-3 under the Exchange Act; |

|

• |

At least one of our directors qualifies as an “audit committee financial expert” as defined by the SEC; |

|

• |

We comply with the requirements of the OTCQX listing standards, including having the compensation committee, the nominating and governance committee and the audit committee comprised solely of independent directors; |

|

• |

We have opted out of the business combination and control share acquisition statutes in the MGCL; |

|

• |

We do not have a stockholder rights plan; |

|

• |

Our chair of the board of directors is separate from our Chief Executive Officer; |

|

• |

Our board of directors and its committees conduct annual self-evaluations; |

|

• |

Our independent directors hold regular executive sessions without management present, presided over by our independent chair; |

|

• |

We do not allow our management or directors to engage in hedging transactions in our stock or to pledge our stock; and |

|

• |

Our directors stay informed about our business by attending meetings of our board of directors and its committees and through supplemental reports and communications. |

Director Criteria and Qualifications

In accordance with our Corporate Governance Guidelines and its charter, the nominating and corporate governance committee is responsible for identifying and evaluating director candidates for the board and for recommending director candidates to the board for consideration as nominees to stand for election at our annual meetings of stockholders. Director candidates are nominated to stand for election to the board in accordance with the procedures set forth in the written charter of the nominating and corporate governance committee.

The nominating and corporate governance committee seeks to achieve a balance of knowledge, experience and capability on our board of directors and considers a wide range of factors when assessing potential director nominees, including a candidate’s background, skills, expertise, diversity, accessibility and availability to serve effectively on the board. All candidates should (i) possess the highest personal and professional ethics, integrity and values, exercise good business judgment and be committed to representing the long-term interests of the Company and its stockholders; and (ii) have an inquisitive and objective perspective, practical wisdom and mature judgment. It is expected that all directors will have an understanding of the Company’s business and be willing to devote sufficient time and effort to carrying out their duties and responsibilities effectively.

The nominating and corporate governance committee accepts stockholder recommendations of director candidates and applies the same standards in considering director candidates submitted by stockholders as it does in evaluating director candidates recommended by members of the board of directors or management. Stockholders may make recommendations at any time, but recommendations of director candidates for consideration as director nominees at our next annual meeting of stockholders must be received not less than 120 days before the first anniversary of the date of the proxy statement for the prior year’s annual meeting of stockholders. Accordingly, to submit a director candidate for consideration for nomination at our 2023 Annual Meeting of Stockholders, stockholders must submit the recommendation, in writing, by no later than the close of regular business hours on December 23, 2022. The written notice must demonstrate that it is being submitted by a stockholder of NewLake and include information about each proposed director candidate, including name, age, business address, principal occupation, principal qualifications and other relevant biographical information. In addition, the stockholder must provide confirmation of each recommended director candidate’s consent to serve as a director and contact information for each director candidate so that his or her interest can be verified and, if necessary, to gather further information.

Director Independence

Our board of directors reviews the materiality of any relationship that each of our directors has with us, either directly or indirectly, taking into account the director nomination rights described under “Certain Relationships and Related Party Transactions—Investor Rights Agreement.” Our board of directors has determined that each of Mr. DuGan, Mr. Carr, Ms. Johnson, Mr. Kadens and Mr. Martay are independent as defined by the listing standards of the OTCQX. There are no family relationships among any of our directors or executive officers.

Role of the Board of Directors in Risk Oversight

One of the key functions of our board of directors is informed oversight of our risk management process. Our board of directors administers this oversight function directly, with support from its standing committees, the audit committee, the nominating and corporate governance committee, the compensation committee and the investment committee, each of which addresses risks specific to their respective areas of oversight. In particular, our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with legal and regulatory requirements. Our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our compensation committee assesses and monitors whether any of our compensation policies and programs have the potential to encourage excessive risk-taking. Our investment committee develops our investment objectives and corporate policies on investing.

Board Leadership Structure

The board of directors believes that it is in the best interests of the Company that the roles of Chief Executive Officer and chair of the board of directors be separated in order for the individuals to focus on their primary roles. The Company’s Chief Executive Officer is responsible for setting the strategic direction for the Company, the day-to-day leadership and performance of the Company, while the chair of the board of directors provides guidance to the Company’s Chief Executive Officer, presides over meetings of the full board of directors and sets the agenda for board of directors meetings.

Corporate Governance Guidelines

Our board of directors adopted corporate governance guidelines that serve as a flexible framework within which our board of directors and its committees operate. These guidelines cover a number of areas including the size and composition of our board of directors, board of directors membership criteria and director qualifications, director responsibilities, board of directors agenda, roles of the chair of the board of directors and chief executive officer, meetings of independent directors, committee responsibilities and assignments, board of directors access to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of senior management and management succession planning. Our nominating and corporate governance committee reviews our corporate governance guidelines at least once a year and, if necessary, recommend changes to our board of directors. Additionally, our board of directors adopted independence standards as part of our corporate governance guidelines. A copy of our corporate governance guidelines is posted on our website at https://www.newlake.com.

Board Committees

Our board of directors has established four standing committees: an audit committee, a compensation committee, a nominating and corporate governance committee and an investment committee. The principal functions of each committee are described below. Additionally, our board of directors may from time to time establish certain other committees to facilitate the management of our company. The directors who serve on these committees and the current chair of these committees are set forth below:

|

Board Member |

Audit |

Nominating and Corporate Governance |

Compensation |

Investment |

Board |

|

Gordon DuGan |

Chair |

X |

Co-Chair |

Chair |

|

|

Alan Carr |

X |

Chair |

X |

||

|

Joyce Johnson |

Chair |

X |

X |

||

|

Peter Kadens |

X |

X |

X |

||

|

Peter Martay |

X |

Co-Chair |

X |

||

|

David Weinstein |

X |

X |

|||

|

Anthony Coniglio |

X |

X |

The board of directors held a total of 13 meetings during 2021. The number of meetings held by each committee of the board of directors during 2021 is set forth below:

|

Audit |

Nominating and Corporate Governance |

Compensation |

Investment |

|

|

Number of meetings |

3 |

0 |

9 |

4 |

During the fiscal year ended December 31, 2021, all incumbent directors who served in fiscal year 2021 attended at least 75% of the aggregate of:

|

• |

the total number of meetings of the board of directors held during the period for which the director had been a director; and |

|

• |

the total number of meetings held by all committees of the board of directors on which the director served during the periods that the director served. |

Our corporate governance guidelines provide that directors are invited and encouraged to attend our Annual Meeting of stockholders. The Company held a 2021 Annual Meeting of Stockholders wherein all of the Company’s then directors were present.

Audit Committee

Our audit committee is comprised of Mr. Carr, Ms. Johnson and Mr. Martay. Ms. Johnson, the chair of our audit committee, qualifies as an “audit committee financial expert” as that term is defined by the applicable SEC regulations and OTCQX corporate governance requirements. Our board of directors has determined that each of the audit committee members is “financially literate” as that term is defined by the OTCQX corporate governance requirements. The board of directors has adopted a written charter for the audit committee, a current copy of which is available to shareholders on our website at https://ir.newlake.com/corporate-governance/governance-documents. Our audit committee charter details the principal functions of the audit committee, including oversight related to:

|

• |

our accounting and financial reporting processes; |

|

• |

the integrity of our consolidated financial statements and financial reporting process; |

|

• |

our systems of disclosure controls and procedures and internal control over financial reporting; |

|

• |

our compliance with financial, legal and regulatory requirements; |

|

• |

the evaluation of the qualifications, independence and performance of our independent registered public accounting firm; |

|

• |

the performance of our internal audit function (notwithstanding the function, the requirement to have internal audits is by the one-year anniversary of our initial public offering); and |

|

• |

our overall risk profile. |

The audit committee is also responsible for engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm, including all audit and non-audit services, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. The audit committee also will prepare the audit committee report required by SEC regulations to be included in our annual proxy statement.

Compensation Committee

Our compensation committee is comprised of Mr. Carr, Mr. DuGan and Mr. Kadens, with Mr. Carr serving as chair. The board of directors has adopted a written charter for the compensation committee, a current copy of which is available to shareholders on our website at https://ir.newlake.com/corporate-governance/governance-documents. Our compensation committee charter details the principal functions of the compensation committee, including:

|

• |

reviewing and approving on an annual basis the corporate goals and objectives relevant to our Chief Executive Officer’s compensation, evaluating our Chief Executive Officer’s performance in light of such goals and objectives and determining and approving the remuneration of our Chief Executive Officer based on such evaluation; |

|

• |

reviewing and approving the compensation of all of our other officers; |

|

• |

reviewing our executive compensation policies and plans; |

|

• |

implementing and administering our incentive compensation equity-based remuneration plans; |

|

• |

assisting management in complying with our proxy statement and annual report disclosure requirements; |

|

• |

producing a report on executive compensation to be included in our annual proxy statement; and |

|

• |

reviewing, evaluating and recommending changes, if appropriate, to the remuneration for directors. |

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is comprised of Mr. DuGan, Ms. Johnson and Mr. Kadens, with Mr. DuGan serving as chair. The board of directors has adopted a written charter for the nominating and corporate governance committee, a current copy of which is available to shareholders on our website at https://ir.newlake.com/corporate-governance/governance-documents. Our nominating and corporate governance committee charter details the principal functions of the nominating and corporate governance committee, including:

|

• |

identifying and recommending to the full board of directors qualified candidates for election as directors and recommending nominees for election as directors at the Annual Meeting of stockholders subject to the terms of the Amended and Restated Investor Rights Agreement (i) nominees to fill vacancies or new positions on the Board; and (ii) the slate of nominees to stand for election by the Company's stockholders at each Annual Meeting of stockholders; |

|

• |

developing and recommending to the board of directors corporate governance guidelines and implementing and monitoring such guidelines; |

|

• |

reviewing and making recommendations on matters involving the general operation of the board of directors, including board size and composition, and committee composition and structure; |

|

• |

recommending to the board of directors, nominees for each committee of the board of directors; |

|

• |

annually facilitating the assessment of the board of directors’ performance as a whole and of the individual directors, as required by applicable law, regulations and the OTCQX corporate governance listing standards; and |

|

• |

overseeing the board of directors’ evaluation of management. |

In identifying and recommending nominees for directors, the nominating and corporate governance committee may consider diversity of relevant experience, expertise and background.

Investment Committee

We have an investment committee comprised of Mr. DuGan, Mr. Martay, Mr. Coniglio and Mr. Weinstein, and may have up to six non-voting advisory members who are not members of our board. Mr. DuGan and Mr. Martay serve as co-chairs. The board of directors has adopted a written charter for the investment committee, a current copy of which is available to shareholders on our website at https://ir.newlake.com/corporate-governance/governance-documents. Our investment committee charter details the principal functions of the investment committee, including developing our investment objectives and corporate policies on investing.

Annual Board Evaluations

Pursuant to our corporate governance guidelines and the charter of the nominating and corporate governance committee, the nominating and corporate governance committee oversees an annual evaluation of the performance of the Board and each committee of the Board. The evaluation process is designed to assess the overall effectiveness of the Board and its committees and to identify opportunities for improving the operations and procedures of the Board and each committee. The process is meant to solicit ideas from directors about (i) improving prioritization of issues; (ii) improving quality of management presentations; (iii) improving quality of Board or committee discussions on key matters; (iv) identifying specific issues that should be discussed in the future; and (v) identifying any other matters of importance to the functioning of the Board or committee. The annual evaluations are generally conducted in the second quarter of each calendar year and the results of the annual evaluation are reviewed and discussed by the Board.

Anti-Hedging Policy

The Company has an anti-hedging policy applicable to directors, officers, and employees. The policy prohibits directors, officers, and employees from engaging in, among other things, short sales, hedging or monetization transactions, such as forward sale contracts, equity swaps, collars, and transactions with exchange funds, or trading in puts, calls, or options, or other derivative securities with respect to the Company’s securities. The Company believes that prohibiting these types of transactions will help ensure that the economic interests of all directors, officers, and employees will not differ from the economic interests of the Company’s stockholders. In addition, the Company has an anti-pledging policy that prohibits directors, officers, and employees from pledging the Company’s shares as collateral for a loan or holding Company shares in a margin account.

Code of Business Conduct and Ethics

Our board of directors has established a code of business conduct and ethics that applies to our officers, directors and employees. Among other matters, our code of business conduct and ethics will be designed to deter wrongdoing and to promote:

|

• |

honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

|

• |

full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; |

|

• |

compliance with applicable laws, rules and regulations; |

|

• |

prompt internal reporting of violations of the code to appropriate persons identified in the code; and |

|

• |

accountability for adherence to the code of business conduct and ethics. |

Any waiver of the code of business conduct and ethics for our executive officers or directors must be approved by a majority of our independent directors, and any such waiver shall be promptly disclosed as required by law or OTCQX requirements.

Clawback Policy

Subject to applicable law, the committee may provide in any grant instrument that if a participant breaches any restrictive covenant agreement between the participant and us, or otherwise engages in activities that constitute cause (as defined in the 2021 Equity Incentive Plan) either while employed by, or providing services to, us or within a specified period of time thereafter, all grants held by the participant will terminate, and we may rescind any exercise of an option or stock appreciation right and the vesting of any other grant and delivery of shares upon such exercise or vesting, as applicable, on such terms as the committee will determine, including the right to require that in the event of any rescission:

|

● |

The participant must return the shares received upon the exercise of any option or stock appreciation right or the vesting and payment of any other grants; or |

|

● |

if the participant no longer owns the shares, the participant must pay to us the amount of any gain realized or payment received as a result of any sale or other disposition of the shares (if the participant transferred the shares by gift or without consideration, then the fair market value of the shares on the date of the breach of the restrictive covenant agreement or activity constituting cause), net of the price originally paid by the participant for the shares. |

Payment by the participant will be made in such manner and on such terms and conditions as may be required by the committee. We will be entitled to set off against the amount of any such payment any amounts that we otherwise owe to the participant. The committee may also provide for clawback pursuant to a clawback or recoupment policy, which our board of directors may adopt from time to time.

Corporate Responsibility and Sustainability

We recognize the importance of environmental, social and governance (“ESG”) issues and incorporate ESG considerations into our business practices and decision-making processes. We believe the growth and sustainability of our business depends on a broad array of factors, including a continuing focus on investments in our people, ethics and integrity, and corporate responsibility.

Environmental Responsibility

|

• |

Application of energy efficient measures in the NLCP corporate office; and |

|

• |

Evaluation of our properties for energy efficiency strategies and discussions with our tenants on improving the energy efficiency of their tenancy within the NLCP portfolio. |

Social Responsibility

|

• |

Focused on ensuring NLCP employee welfare, health, and development in the corporate office; |

|

• |

Commitment to diversity & inclusion in the NLCP workplace; and |

|

• |

Offer NLCP employees a competitive, comprehensive benefit package and training sessions to promote education. |

Corporate Governance

|

• |

A significant portion of C-Suite incentive compensation is received in performance-based stock or restricted stock pursuant to our 2021 Equity Incentive Plan; |

|

• |

Non-Executive chair of the Board and 71% of the board of directors are independent directors; and |

|

• |

Reporting and disclosure with an emphasis on transparency. |

Human Capital Resource Management

As of December 31, 2021, we employed seven full-time employees. Our employees are our most valuable asset and critical to our long-term success. We believe we have created an inclusive and engaging work environment, where each person is an integrated member of the team. We meet regularly as a full team, including throughout the COVID-19 pandemic, and each member is encouraged to actively participate in a wide range of topics relating to our company’s business activities.

We are also committed to the health and safety of our employees. During 2020 and to date, as a result of the COVID-19 pandemic, we have implemented a number of safety protocols to protect our employees, including remote working opportunities.

While we are a young company, having commenced operations in 2019 and completed our initial public offering in August 2021, we have a seasoned team of people with meaningful experience across real estate, cannabis and financial services. We believe that attracting, developing and retaining our team is a high priority. To that end, we believe we offer a highly competitive compensation (including salary, bonuses and equity) and benefits package for each member of our team, which include the following:

● Comprehensive health insurance, including medical, dental and vision, to each employee at no cost to the employee;

● At least three weeks of paid time off each year for each employee, which are in addition to Company holidays;

● Life and Disability insurance; and

● Company sponsorship of continuing education courses related to our Company’s business.

We are also proud to be an equal opportunity workplace and employer. We are committed to the principle of equal employment opportunity for all employees and to providing employees with an inclusive work environment free of discrimination and harassment. All employment decisions are based on qualifications, merit and business needs, without regard to race, color, creed, gender, religion, sex, national origin, ancestry, pregnancy, age, marital status, registered domestic partner status, sexual orientation, gender identity, protected medical condition, genetic information, physical or mental disability, veteran status, or any other status protected by the laws or regulations in the locations where we operate.

We endeavor to maintain workplaces that are free from discrimination or harassment on the basis of color, race, sex, national origin, ethnicity, religion, age, disability, sexual orientation, gender identification or expression or any other status protected by applicable law. The basis for recruitment, hiring, development, training, compensation and advancement at the Company is qualifications, performance, skills and experience. We believe our employees are fairly compensated, and compensation and promotion decisions are made without regard to gender, race and ethnicity.

Covid-19 Health and Safety

In response to the COVID-19 pandemic, we promptly transitioned all of our employees to remote working, without significant impact to productivity. At our corporate office, we provide cleaning supplies and facial coverings to all employees and visitors who chose to work in the office, among other safety measures to help reduce the potential transmission of the disease.

Communications with the Board of Directors

Stockholders and other interested parties who wish to communicate with the board of directors or any of its committees may do so by writing to the chair of the Board, board of directors of NewLake Capital Partners, Inc., c/o Secretary, 27 Pine St, Suite 50 New Canaan, CT 06840. The Secretary will review all communications received. All communications that relate to matters that are within the scope of the responsibilities of the board of directors and its committees are to be forwarded to the chair of the Board. Communications that relate to matters that are within the scope of responsibility of one of the Board committees are also to be forwarded to the chair of the appropriate committee. Solicitations, junk mail and obviously frivolous or inappropriate communications are not to be forwarded but will be made available to any director who wishes to review them.

PROPOSAL NO. 2. RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

On April 20, 2022, the audit committee approved appointing BDO USA, LLP to serve as NLCP’s independent public accountants for the fiscal year ending December 31, 2022. BDO USA, LLP has served as our independent public accountants since 2021. On April 12, 2021, with the approval of the Company's audit committee, the Company dismissed Davidson & Company LLP (“Davidson”) as the Company's independent registered public accounting firm. Davidson's audit report on the Company's consolidated financial statements as of December 31, 2020 and December 31, 2019, did not contain an adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope, or accounting principles. During the Company's existence, there were no (a) disagreements between the Company and Davidson on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Davidson, would have caused Davidson to make reference to the subject matter of the disagreement in its report on the Company's consolidated financial statements, or (b) “reportable events” as that term is defined in Item 304(a)(1)(v) of Regulation S-K under the Exchange Act.

We are asking our stockholders to ratify the appointment of BDO USA, LLP as our independent registered public accountants for our fiscal year ending December 31, 2022. Although ratification is not required by our Bylaws or otherwise, the board of directors is submitting the appointment of BDO USA, LLP to our stockholders for ratification as a matter of good corporate practice. In the event stockholders do not ratify the appointment, the appointment will be reconsidered by the audit committee. Even if the appointment is ratified, the audit committee at its discretion may select a different registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of NLCP. A representative of BDO USA, LLP is expected to be present at the Annual Meeting, will have an opportunity to make a statement if he or she so desires and is expected to be available to respond to appropriate questions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE APPOINTMENT OF BDO USA, LLP TO AUDIT THE FINANCIAL STATEMENTS OF NLCP FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022.

Audit Fees

The following table presents the aggregate fees billed by our auditors for each of the services listed below for the years ended December 31, 2021 and 2020.

|

2021 |

2020 |

|||||||

|

Audit Fees |

$ | 756,810 | (1) | $ | 100,000 | (2) | ||

|

Audit-Related Fees |

- | - | ||||||

|

Tax Fees |

55,155 | - | ||||||

|

All Other Fees |

- | - | ||||||

|

Total |

$ | 811,965 | $ | 100,000 | ||||

|

(1) |

Audit fees consist of $356,985, the aggregate fees billed for professional services rendered by BDO USA, LLP in connection with its audit of our consolidated financial statements and reviews of our quarterly reports on Form 10-Q. Audit fees also include $332,325 for certain additional services rendered by BDO USA, LLP, associated with our initial public offering and subsequent registration statement. Additionally, audit fees consist of $67,500, the aggregate fees billed for professional services rendered by Davidson & Company LLP, our prior auditors, in connection with providing a comfort letter and consents for various 2021 SEC filings. |

|

(2) |

Audit fees consist of the aggregate fees billed for professional services rendered by Davidson & Company LLP in connection with its audit of our consolidated financial statements. |

Exchange Act rules generally require any engagement by a public company of an accountant to provide audit or non-audit services to be pre-approved by the audit committee of that public company. This pre-approval requirement is waived with respect to the provision of services other than audit, review or attest services if certain conditions set forth in Rule 2-01(c)(7)(i)(C) of Regulation S-X are met. All of the audit and audit-related services described above were pre-approved by the audit committee and, as a consequence, such services were not provided pursuant to a waiver of the pre-approval requirement set forth in this Rule. The audit committee charter provides guidelines for the pre-approval of independent auditor services. All of the audit services described above were completed by full-time, permanent employees of BDO USA, LLP.

Audit Committee Report

In connection with the preparation and filing of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021:

|

• |

The audit committee of the board of directors of NLCP has reviewed and discussed the audited financial statements included in our Annual Report on Form 10‑K for the year ended December 31, 2021 with NLCP’s management and BDO USA, LLP, the Company’s independent registered public accounting firm; |

|

• |