The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion,

Preliminary Prospectus dated June 21, 2021

PROSPECTUS

Shares

NewLake Capital Partners, Inc.

Common Stock

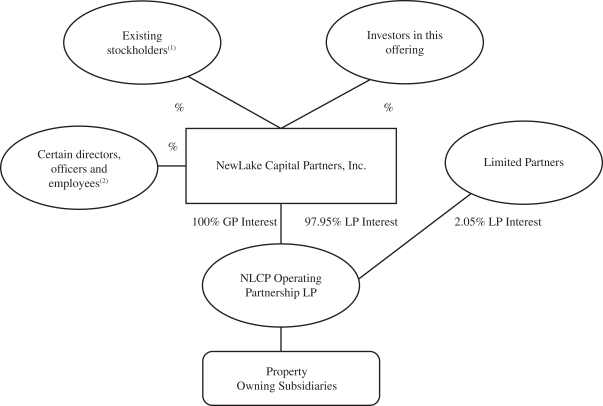

NewLake Capital Partners, Inc., a Maryland corporation, is an internally-managed real estate investment trust for federal income tax purposes (“REIT”) that provides real estate capital to state-licensed cannabis operators through sale-leaseback transactions, third-party purchases and funding for build-to-suit projects. As of March 31, 2021, we owned a portfolio of 24 industrial properties and dispensaries utilized in the cannabis industry that were leased to single tenants on a triple-net basis.

This is our initial public offering. We are offering shares of our common stock. All of the shares of common stock offered by this prospectus are being sold by us.

We expect the initial public offering price of our common stock to be between $ and $ per share. Currently, no public market exists for our common stock. We have applied to have our common stock quoted on the OTCQX® Best Market operated by OTC Markets Group, Inc. (the “OTCQX”). Quotation of our common stock will be subject to us fulfilling all of the listing requirements of the OTCQX. Each share will be issued directly to certain institutional investors pursuant to this prospectus and a securities purchase agreement.

We elected to be taxed as a REIT commencing with our short taxable year ended December 31, 2019. Shares of our common stock are subject to limitations on ownership and transfer that are primarily intended to assist us in maintaining our qualification as a REIT. Our charter generally prohibits any person from actually, beneficially or constructively owning more than 7.5% in value or number of shares, whichever is more restrictive, of the outstanding shares of our common stock or of the outstanding shares of any class or series of our preferred stock or more than 7.5% in value or number of shares, whichever is more restrictive, of the aggregate outstanding shares of all classes and series of our stock. See “Description of Stock—Restrictions on Ownership and Transfer.”

We are an “emerging growth company” and a “smaller reporting company” under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 21 of this prospectus for a discussion of certain risk factors that you should consider before investing in our common stock.

We have retained Ladenburg Thalmann & Co. Inc. and Compass Point Research & Trading LLC as placement agents for this transaction. The placement agents are not purchasing or selling any of our securities offered by this prospectus, nor are they required to arrange the purchase or sale of any specific number or dollar amount of securities; however, the placement agents have agreed to use their reasonable best efforts to arrange for the sale of all of our securities offered hereby. There is no required minimum number of securities that must be sold as a condition to completion of the offering. We have agreed to pay the placement agent the placement agent fees set forth in the table below.

| Per Share | Total(2) | |||||||

| Public offering price |

$ | $ | ||||||

| Placement agent fees(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | We have also agreed to reimburse the placement agents for certain of their legal fees and expenses in connection with this offering. For additional information about the compensation paid to the placement agents, see “Plan of Distribution” on page 182. |

| (2) | Assumes that shares are sold in this offering. |

We expect that delivery of shares being offered pursuant to this prospectus will be made on or about . Pursuant to an escrow agreement among us, the placement agents and Cadence Bank, N.A., as escrow agent, all of the funds received in payment for the shares sold in this offering will be wired to a non-interest bearing escrow account and held until we and the placement agents notify the escrow agent that this offering has closed, indicating the date on which the shares are to be delivered to the purchasers and the proceeds are to be delivered to us.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of common stock is expected to be made on or about , 2021.

| Ladenburg Thalmann | Compass Point |

The date of this prospectus is , 2021.